Sep 19, 2022

Kuroda’s BOJ Set to Become World’s Last Negative Rate Holdout

, Bloomberg News

(Bloomberg) -- The Bank of Japan’s outlier status is set to become even more acute this week with central banks from the Federal Reserve to the Swiss National Bank expected to raise borrowing costs.

Bank of Japan Governor Haruhiko Kuroda and his fellow board members are seen standing pat at the end of a two-day meeting Thursday that comes just hours after the Fed unleashes what’s likely to be a third-straight interest rate hike of 75 basis points.

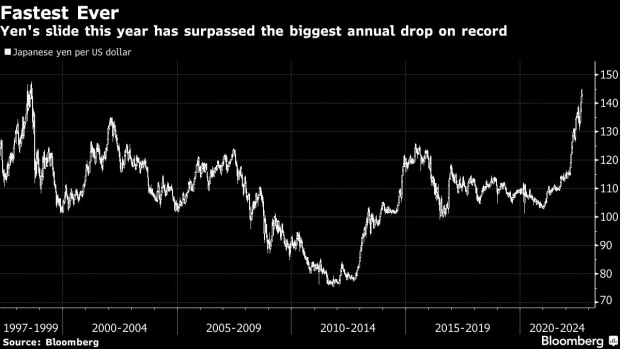

With the BOJ likely to be clinging to the world’s only negative policy rate, its dovish stance may send the embattled yen sliding again.

Authorities in Tokyo ramped up their warnings against the rapid yen moves after it flirted with 24-year-lows against the dollar last week. The country’s finance minister indicated that direct intervention is among the options on the table and, if needed, it will come swiftly and without warning.

Despite the concern over the currency, Kuroda remains unmoved.

The governor has said a rapid weakening of the yen is undesirable. But even after the yen hit 144.99 earlier this month, the BOJ continues to hold the view that a weak yen is positive for the economy overall if it’s stable, according to people familiar with the matter.

“The yen may breach 145, but simply piling into selling the currency could be like playing with fire,” said Kyohei Morita, chief economist at Nomura Securities. “What’s different this time is traders will have to weigh Kuroda’s unchanged easing stance against the strong warnings by Japan’s currency officials.”

Even if the BOJ tried to tweak policy in response to the yen, it would be largely futile, Kuroda has indicated.

Massive hikes would be necessary to stop the yen’s slide and that would end up breaking the economy in the middle of a pandemic, he said in July. Rate raises to normalize policy can only come with sustainable inflation and for that Japan needs robust wage growth, he has said.

Still, the BOJ’s stance comes with an increasing cost. While it keeps its short-term interest rate at -0.1%, a 0.25% cap it enforces on 10-year government debt is under renewed pressure.

A global bond selloff pushed the yield to that upper limit last week for the first time since June. The central bank had to spend 1.4 trillion yen ($9.8 billion) to buy bonds in defence of yields on Wednesday and Thursday alone.

Hideo Hayakawa, a former BOJ executive director, told Bloomberg that the bank should tweak its yield curve control since the peg is causing the currency to weaken so much.

BOJ officials have already said that raising the yield cap would be equivalent to increasing interest rates, essentially ruling it out as an option until that sustainable inflation is achieved.

While Kuroda waits for signs of lasting price gains and higher wages, Japan’s inflation continues to strengthen at a faster pace than expected. Key consumer prices rose 2.8% in August, according to a government report Tuesday. That’s above the BOJ’s 2% target, leaving the central bank with more explaining to do as it looks to justify its continued easing on Thursday.

Read More: Japan’s Inflation Hits 31-Year High, Creating Headaches for BOJ

If a surprise were to come, a tweak to guidance on future rates would be an easier choice than tinkering with the yield peg. The bank currently expects rates to stay “at their present or lower levels.”

Economists are set to watch the central bank’s guidance this week since almost 80% of them expect the BOJ to end the remaining part of its special Covid funding program as scheduled.

The central bank currently links a part of guidance on policy with the pandemic, so an end to the program suggests a possible change in wording. Still, analysts see the key phrase on rates staying unchanged for now in favor of low or lower rates.

“The focus is what they will tie it to instead of Covid,” said Naomi Muguruma, chief fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities in Tokyo. “That easing bias will stay unchanged.”

(Adds details of latest inflation release)

©2022 Bloomberg L.P.