Jul 21, 2022

Lagarde Bids for ECB to Defy History With Third-Time-Lucky Hike

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

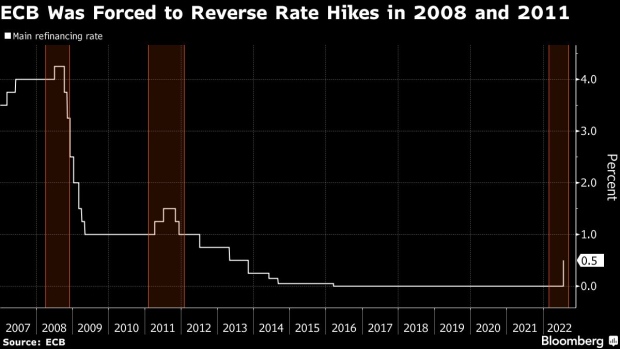

The European Central Bank reckons it can defy a record of aborted interest-rate hikes as it raises borrowing costs while confronting a recession threat and Italian political turmoil.

The half-point increase delivered on Thursday allows President Christine Lagarde and her colleagues to join the global fight against inflation with a larger-than-expected initial salvo -- carrying the risk of doubling down on another policy error.

This is the third time in the near quarter-century of the ECB’s history that it’s raised rates with a crisis of some sort blazing in the background. On each occasion it did so in July -- and both prior hikes were reversed within months.

The danger of a mistake “is there, I don’t want to play it down,” said Martin Weder, an economist at Zuercher Kantonalbank in Zurich who was one of very few to predict the half-point move. “This time it’s more a latent risk in the shape of an energy crisis.”

While the bigger increase now may reflect a desire to play catch-up after hesitating, policy makers are also aware of the perils of inflicting damage on a vulnerable economy. Meanwhile, the euro’s shaky foundations were highlighted by the collapse of Italy’s government hours before the outcome on Thursday.

The rate hike was an acceleration rather than a change in the endpoint where policy will ultimately arrive, Lagarde said.

Hetal Mehta, an economist at Legal & General Investment Management in London, speculated that the ECB is taking advantage of a chance to act before growth slows even further.

“At a time when the economy is still recovering from Covid, they had a window of opportunity to move sooner,” she said. “Equally, they are compressing that timetable by hiking it at that pace.”

JPMorgan Chase & Co. economists changed their forecast for ECB rates to reflect the more aggressive start, predicting quarter-point increases at each of this year’s remaining three meetings, though reaching the same level as they previously anticipated.

A few officials began this week’s discussion seeking the smaller quarter-point move that Lagarde had all but promised to investors beforehand, according to people familiar with the matter. They ultimately coalesced unanimously around a bigger hike.

Out of the policy makers there, only Dutch Governor Klaas Knot was present when the ECB last raised rates in July 2011 as the region’s sovereign-debt crisis was already raging. A move lower was enacted before the year was out.

A previous hike in July 2008, before the global financial crisis reached its climax, was also quickly undone as banking systems buckled.

This time around, the economy is under threat, with the region’s dependence on Russian energy leaving the European Union bracing for a total natural gas cutoff. Lagarde publicly acknowledged a slowdown, describing President Vladimir Putin’s war in Ukraine as “an ongoing drag” and noting the impact of a cost-of-living crisis.

“We have in Europe stagflationary pressures,” former ECB Chief Economist Peter Praet told Bloomberg Television. “Inflation is quite high, but also we have risks to growth.”

The European Commission reckons the economy stagnated in the second quarter, and predicts just 0.3% expansion in each of the next two. Its forecasts show Estonia and Lithuania are probably already in recession, with Austria, Luxembourg and Belgium teetering.

The likelihood of a contraction has increased to 45% from 30% in June, according to a Bloomberg survey of economists published last week.

The ECB doesn’t publish new forecasts until September, but the International Monetary Fund has already warned that it will cut its global outlook “substantially” next week.

In the meantime, Italy’s return to political turbulence after the resignation of Prime Minister Mario Draghi has cast a shadow over efforts to tame one of the region’s highest debt burdens -- and underlined its vulnerability to higher borrowing costs.

The ECB tempered that threat on Thursday by unveiling a new crisis tool that could be deployed to contain the fallout of its higher rates.

Lagarde also argued forcefully for the half-point move she delivered, insisting that the risks posed by record euro-zone inflation justified that. Her warning on growth was accompanied by some optimism about how a bumper summer for tourism without pandemic restrictions may still help.

Weder at Zuercher Kantonalbank says only hindsight will show whether the ECB’s decision was mistaken.

“The mandate clearly is price stability,” he said. “As long as it isn’t obvious that we’re in an energy crisis or in a recession, the strategy should be to continue increasing interest rates.”

©2022 Bloomberg L.P.