Jan 19, 2023

‘Large Number’ of ECB Officials Backed Bigger December Hike

, Bloomberg News

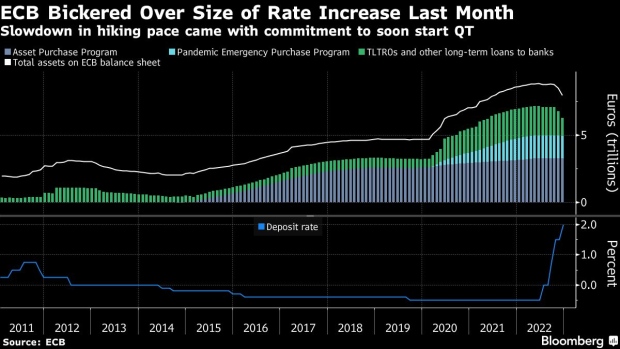

(Bloomberg) -- European Central Bank President Christine Lagarde faced preferences for a more aggressive inflation response last month, with officials eventually compromising on a smaller interest-rate increase alongside hawkish messaging and a bargain over shrinking the institution’s bond portfolio, an account of their last meeting showed.

“A large number” of officials initially preferred a 75 basis-point hike, rather than the half-point move proposed by Chief Economist Philip Lane, according to the account, published Thursday. Some ultimately agreed to the smaller step, accompanied by a public pledge by Lagarde for more increases of that size at following meetings.

Officials also agreed on a slower speed for quantitative tightening than some had sought.

Slowing inflation, plunging energy prices and a stronger euro are now calling into question the idea that half-point hikes persist beyond February, according to officials with knowledge of the thinking. While policymakers are shifting focus to record gains in underlying prices, rather than the headline number, the ECB has already tightened monetary policy more aggressively than any time in its history.

What Bloomberg Economics Says:

“On balance, the hawkishness of the minutes, the latest economic news and recent remarks from policymakers suggest it is becoming more likely that a 50 basis-point hike in February will be followed by another in March.”

—Jamie Rush and Maeva Cousin. Click here for full REACT

Here are the key comments from the ECB’s account:

Interest Rates

- “A large number of members initially expressed a preference for increasing the key ECB interest rates by 75 basis points, as inflation was clearly expected to be too high for too long and prevailing market expectations and financial conditions were plainly inconsistent with a timely return to the ECB’s 2% inflation target”

- “Some of these members, nonetheless, expressed their willingness to agree on a 50 basis-point rate rise if a majority were to support the proposal put forward by Mr Lane, taking into account the strengthened communication on the Governing Council’s policy intentions and the enhanced message that the Governing Council would continue raising rates significantly at a sustained pace, which were also part of the proposal”

- “This was in some ways seen as broadly equivalent to raising rates by 75 basis points at the present meeting, because a less frontloaded but steadier approach to bringing interest rates to restrictive levels could be seen as consistent with the more persistent nature of the inflation process and continued elevated uncertainty”

Inflation

- “The latest data suggested that inflation was becoming much more broad-based and persistent. While the decline in headline inflation in November had been unexpected, inflation was still higher than projected in September”

- “Even if headline inflation numbers came down sharply in the course of 2023, largely owing to base effects, this was not likely to be the case for underlying inflation. Measures of underlying inflation continued to display very strong month-on-month dynamics”

- “This was also reflected in the projections, which saw core inflation higher in 2023 than in 2022, more persistent and clearly above target in 2025. This implied an increased risk of inflation becoming entrenched in the euro-area economy”

Quantitative Tightening

- “Some members expressed a preference for reducing the APP portfolio at a faster pace or for terminating reinvestments altogether”

- “It was cautioned, however, that too fast a pace of reduction could lead to the re-emergence of bond market fragmentation, which could make further interest rate increases more difficult to pursue. From that perspective, a moderate pace was seen as more appropriate, in particular as a reduction of the balance sheet was estimated as likely to have only a limited impact on the inflation outlook”

The Economy

- “The Governing Council had to be careful not to dampen demand excessively as rates moved into restrictive territory, thereby exacerbating the projected recession”

--With assistance from Zoe Schneeweiss and Craig Stirling.

(Updates with comment from Bloomberg Economics.)

©2023 Bloomberg L.P.