Mar 2, 2023

Lazard Says TSMC Is a Top Stock After Buffett Abruptly Dumped It

, Bloomberg News

(Bloomberg) -- Lazard Asset Management said it’s been scooping up shares of Taiwan Semiconductor Manufacturing Co., the chipmaker that Warren Buffett’s Berkshire Hathaway Inc. abruptly unloaded last month without explanation.

Berkshire’s reversal on TSMC was an uncharacteristic move for the world’s most famous buy-and-hold investor. The Omaha, Nebraska-based conglomerate revealed on Feb. 15 that it had slashed its stake by 86%, sending the company’s shares tumbling as investors tried to figure out why. Just three months earlier, Berkshire’s stake was worth about $5 billion, Bloomberg calculations showed.

A representative for Berkshire didn’t respond to a request for comment on the sale. Lazard declined to say whether it had added to its TSMC position since the Berkshire filing.

But at the portfolio management unit of Lazard, one of the world’s best-known investment and advisory firms for emerging markets, TSMC is now the second-biggest holding in its emerging-markets equity portfolio by value, according to data compiled by Bloomberg.

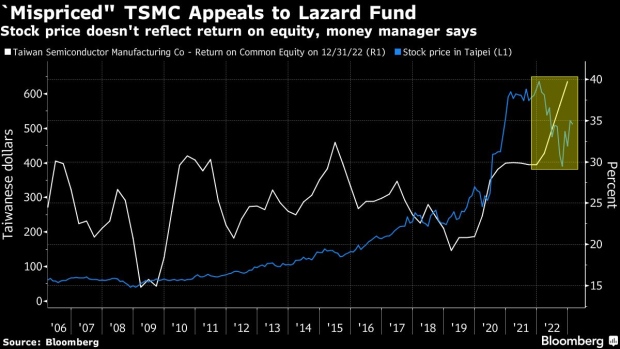

‘Mispriced’

James Donald, the $184 billion fund’s New York-based head of emerging markets, told Bloomberg a week after the Berkshire news that TSMC is one of his top stocks and he’s been buying more lately because it’s “much more of a mispriced security today than it was before.”

He cites the company’s price-to-earnings ratio, which has dropped to about 13 from more than double that, compared with a return on equity of more than 30%. Lazard started buying the stock in 2006, and Donald said he nearly exited it, too, when valuations started to look too frothy a couple years ago.

“We were very close to selling our entire position, we still had some upside but not a lot, and then the stock derated over the course of the course of last year,” he said. “Since then we have been adding to our positions.”

TSMC fell 34% last year alongside other hardware and semiconductor producers as investors weighed Covid 19-induced supply disruptions and a slump in demand for electronics as inflation surged. A shortage of chips during the pandemic highlighted the world’s reliance on a handful of producers, and turned the issue into a fierce point of contention between China and the US.

READ MORE: Why Making Computer Chips Has Become a New Arms Race: QuickTake

TSMC’s US-listed shares are up 19% this year and it’s the largest stock by weight on MSCI’s benchmark emerging-market index. The stock has 30 “buy” ratings out of 33 analyst recommendations on Bloomberg, with no “sell” calls. That makes Berkshire’s decision to exit appear to be even more of an outlier.

Lazard’s US-listed emerging-markets equities fund is up 6.9% so far this year, outperforming more than 90% of peer funds and the MSCI index, which is up 2.5%, according to data compiled by Bloomberg.

Charlie Munger

While Berkshire hasn’t elaborated on the reasons for its reversal on TSMC, Charles Munger, the company’s 99-year-old vice chairman, talked about the company at an annual shareholder meeting for news publisher the Daily Journal Corporation last month.

TSMC is “the strongest semiconductor company on earth,” he said, but the business is difficult, there’s no guaranteed long-term winner, and competing in semiconductors requires enormous amounts of spending.

“The semiconductor industry is a very peculiar industry. In the semiconductor industry, you have to take all the money you’ve made, and with each new generation of chips, you throw in all the money you’ve previously made, so it’s a compulsory investment of everything you want to stay in the game,” Munger said. “Naturally, I hate a business like that.”

For Lazard’s Donald, though, TSMC’s ability to generate return on lavish capital expenditure is a positive.

“They have spent substantially on capital expenditure but they have been one of the relatively few companies that have done that and still made very, very good profits,” he said. “It is a rare thing in our opinion to see companies to spend heavily on capex but be able to get a very good return on that.”

--With assistance from Srinivasan Sivabalan and Max Reyes.

©2023 Bloomberg L.P.