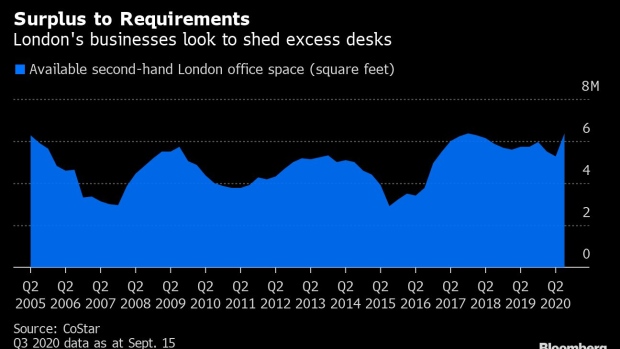

(Bloomberg) -- London firms are dumping their unwanted office space as the pandemic forces tenants to review their real-estate needs.

Excess space being offered for rent by companies in the capital has surged to the most in at least 15 years as businesses look to cut costs and shift more staff to long-term home working, according to research by real-estate data company CoStar Group Inc.

More than 1 million square feet (92,900 square meters) has become available for sublet since June, the equivalent of two Gherkin skyscrapers. The trend is so far limited to London: the city’s second-hand space surged by 21% in the period, compared with just a 1% increase for the rest of the U.K.

“The success of home working, coupled with ongoing concerns around public transport and coronavirus infections, has led many firms to reconsider their office space needs,” Mark Stansfield, head of U.K. analytics at CoStar, wrote in a note to clients. “Some of this impact is now being seen in the data.”

Second-hand space poses a threat to developers building new offices, offering tenants seeking to move a cheaper alternative. While newly developed space that has yet to be leased in London remains relatively scarce, overall vacancy rates are increasing due to the buildings being offered up by companies that no longer need them.

Banks including Credit Suisse Group AG, HSBC Holdings Plc and Nomura Holdings Inc. are among those companies currently trying to rent out excess space they no longer need, Bloomberg News reported.

©2020 Bloomberg L.P.