Jan 26, 2022

London Metal Exchange Gets New Member for Embattled Trading Pits

, Bloomberg News

(Bloomberg) -- Sigma Broking has been given the green light to trade on the London Metal Exchange’s floor, in a bold bet that the historic open-outcry pit will survive a recent slump in volumes.

The LME approved the company as a floor-dealing member, according to three people familiar with the matter, who asked not to be identified as the information isn’t public. London-based Sigma is planning to start with a team of about 15 people, which will make it one of the largest dealers on the exchange’s famous trading floor known as the Ring, one of the people said.

The Ring was forced to shut in 2020 as the pandemic struck, though reopened in September after brokers led a campaign to save it from permanent closure. But with only some pricing functions returning to the floor, volumes have slid sharply, and some brokers have been doubtful about the Ring’s long-term viability.

The trading pit may now get a bit of a lift. Futures dealer Sigma has a large roster of commodities clients including traders and hedge funds, and sees opportunities in bringing their order flow to the exchange, one of the people said.

Read more: London’s Beleaguered Metals Ring Gets Contrarian Bet on Revival

The furore over the LME’s plans to close the floor has strained relations with its members in recent months, and last week Chief Executive Officer Matthew Chamberlain stepped down to take on a new role at a blockchain startup. The head of the LME’s clearing house, Adrian Farnham, will helm the exchange on an interim basis when Chamberlain leaves at the end of April.

Sigma has been planning the move for a number of years, and the company had aimed to start trading late last year. The firm has seen strong interest from clients in the energy sector who are looking to expand in metals as the green-energy revolution starts to take root, in a trend that could help revive volumes on the bourse, the person said.

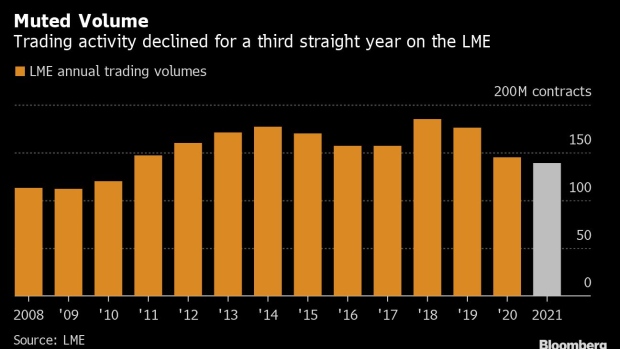

The LME’s trading volumes dipped to the lowest in more than a decade last year, marking a further slowdown in activity on the top industrial metals bourse even as prices hit record highs.

Sigma is majority-owned by futures trader Matthew Kent and its chief executive officer is David Mudie, filings with U.K. Companies House show. It was co-founded by Kent in 2008 as an interest-rate futures and options broker, and has since expanded into fixed income, commodities and energy, according to its website.

©2022 Bloomberg L.P.