Mar 21, 2023

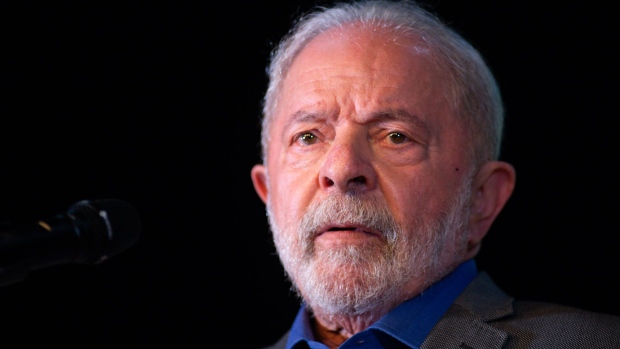

Lula Escalates Attacks on Brazil Central Bank Before Rate Decision

, Bloomberg News

(Bloomberg) -- President Luiz Inacio Lula da Silva stepped up attacks on Brazil’s central bank, calling it “irresponsible” for maintaining borrowing costs at a six-year high, on the eve of monetary policy decision that’s expected to bring no change to the benchmark Selic.

“What I find truly absurd is interest rates at 13.75%,” Lula said on Tuesday in an interview with a local website. Such a level has “no logic” because inflation isn’t caused by excess demand, he said. “I’ll keep talking about this and fighting to lower interest rates so the economy recovers investments.”

Policymakers led by Roberto Campos Neto are forecast to keep rates unchanged at 13.75% for the fifth straight time on Wednesday. That stance has irked Lula, who has publicly attacked the central bank since taking office in January, claiming the institution is jeopardizing the economic recovery he promised during his campaign. Gross domestic product shrank at the end of last year and analysts expect expansion below 1% in 2023.

Read More: Faltering Economy Endangers Lula’s ‘Barbecue and Beer’ Promise

Meanwhile, annual inflation slowed down less than expected in February, and most analysts see consumer prices increasing above target through 2025.

In his remarks, Lula reiterated his criticism of central bank autonomy. “He needs to control inflation but also look after jobs, things he doesn’t care about,” he said, in reference to Campos Neto. The president acknowledged that the current law puts the ability to dismiss the central bank chief in the hands of the Senate.

Lula also said the government will present its proposal for new public spending rules after he returns from this month’s trip to China. The new fiscal framework has been touted by Finance Minister Fernando Haddad as a plan to assuage investor concerns about Brazil’s budget and help the central bank cut interest rates.

Key members of Lula’s Workers’ Party have also criticized the central bank in recent weeks, some of them demanding Campos Neto’s resignation. The central bank chief has repeated he intends to stay on his post until his mandate ends in December 2024.

--With assistance from Bruna Lessa.

©2023 Bloomberg L.P.