Jun 20, 2023

Mackenzie Investments cuts jobs, including senior management, in shakeup by new CEO

, Bloomberg News

'Economic slowdown possibly coming in Q4' or 2024: CIO

Mackenzie Investments has cut about 50 jobs, including senior executive roles, as part of a restructuring by new chief executive officer Luke Gould, people familiar with the matter said.

The reductions at one of Canada’s largest mutual fund managers came in two rounds, according to the people, speaking on condition they not be identified because they aren’t authorized to discuss the matter. The first involved executives including Michael Schnitman, the head of alternative investments, and Michael Cooke, head of exchange-traded funds.

Mackenzie then did another round of layoffs that eliminated dozens of jobs in a streamlining of the investment team, the people said, resulting in the departure of Canadian portfolio managers including Adam Rivers and Clayton Bittner. The firm, which managed $190.2 billion as of the end of May, now has approximately 1,350 employees, so the cut represents between 3 per cent and 4 per cent.

“After conducting a review, we have made changes to our organization over the last two months to simplify our leadership structure, position Mackenzie for continued growth and continue to provide investment excellence and strong client outcomes,” the firm said in an emailed statement to Bloomberg.

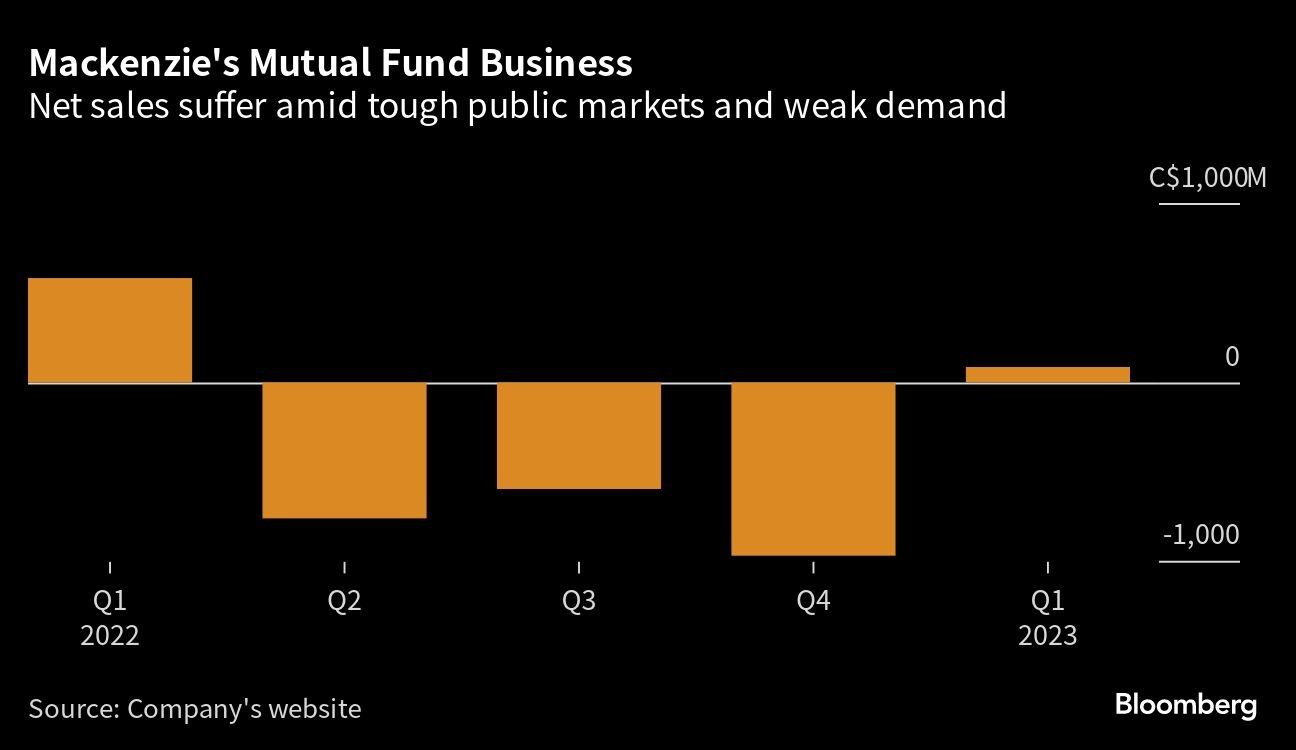

Mackenzie has been suffering from weak sales in its mutual fund business, with the sector facing headwinds from lower-cost products such as exchange-traded funds and the growing dominance of the Canada’s big banks in selling investment products. Asset managers globally have also been hit by market volatility and rising interest rates, which led to a selloff in bonds and equities in 2022.

The restructuring aims to reduce duplication and consolidate assets under fewer people, one of the people said.

Gould took over as Mackenzie’s CEO last July, the latest step in a 25-year rise within parent company IGM Financial Inc., which he joined in 1997. Previously, he was IGM’s chief financial officer.

Some employees were assigned different roles in other units under the IGM umbrella. Ryan Dickey, Mackenzie’s co-head of retail distribution, moved over to private equity arm Northleaf Capital Partners Ltd. as managing director of Canadian retail partnerships. Mackenzie had a 56 per cent economic interest in Northleaf as of December.

IGM, controlled by the Desmarais family of Quebec, also has investments in online brokerage Wealthsimple Inc. and Greenchip Financial Corp., a Toronto-based boutique focused on environmentally sound investments.

With assistance from Paula Sambo.