Mar 14, 2024

Markets Showing Signs of Bubble on Big Tech, Crypto Surge, BofA’s Hartnett Says

, Bloomberg News

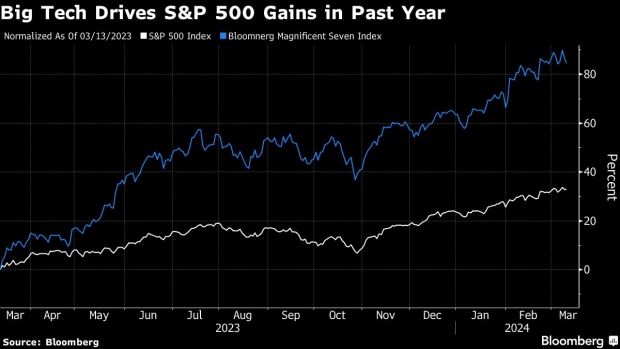

(Bloomberg) -- Markets are showing characteristics of a bubble in the record-setting surge by tech’s so-called Magnificent Seven stocks and the all-time highs in cryptocurrencies, according to Bank of America Corp. Chief Investment Strategist Michael Hartnett.

With inflation re-accelerating, growth a little soft and risk assets unscathed, “that is very symptomatic of a bubble mentality,” Hartnett said Thursday in a Bloomberg TV interview. Characteristics of a bubble can be seen in prices, the pace of the moves, in valuations and in the narrowness of the gaining assets.

In moves that underscore the “tremendous euphoria” Hartnett said he sees in markets, the S&P 500 has reached record highs 17 times this year, with artificial intelligence darling Nvidia Corp. soaring more than 80%. Bitcoin hit an all-time high for the fourth time in six days this week, bolstered by massive inflows into US exchange-traded funds tied to the cryptocurrency.

Just how stretched markets are is a live debate on Wall Street. Other strategists have recently downplayed concerns that the gains in US technology megacaps are overdone, including JPMorgan Chase & Co.’s Mislav Matejka. Part of the counter-argument to Hartnett’s view is that the top stocks trade at much lower valuations than the largest names did at the peak of the tech bubble.

For Hartnett, investors are “front-running” the Federal Reserve’s determination to reduce interest rates, helping to drive the gains in gold and crytpo to unprecedented levels.

“I think that’s representative of a feeling that the Fed is losing credibility, that the Fed seems very determined to cut interest rates before it reaches its 2% inflation target.”

While the bubble isn’t necessarily about to pop, there are some ominous signs from US economic data, said Hartnett, who sees evidence that the labor market is cracking. “The labor market is what can take a soft landing and make it a hard landing very quickly.”

©2024 Bloomberg L.P.