Apr 6, 2020

Mass layoffs push Canada's consumer confidence to all-time low

, Bloomberg News

'There is a second war going on' for the prosperity of Canada: Nik Nanos

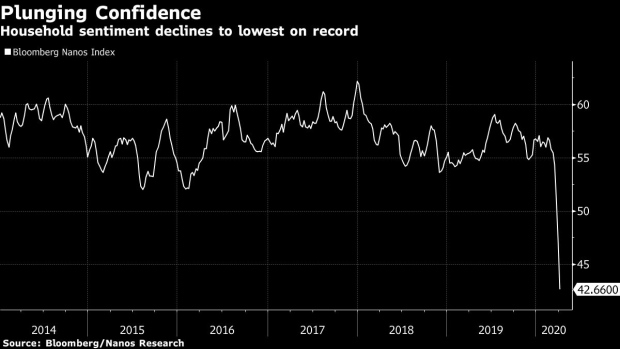

Consumer confidence fell to a record low last week, surpassing even the worst numbers from the Great Recession after the coronavirus pandemic shut down much of the economy.

The Bloomberg Nanos Canadian Confidence Index, a composite gauge based on a telephone survey of households, declined sharply for a third week as extensive lockdowns triggered mass layoffs. The aggregate index dropped to 42.7 last week, the lowest reading since polling began in 2008.

The survey paints a bleak picture of economic anxiety across regions, age groups and most income levels.

- Almost three quarter of respondents (74 per cent) believe the nation’s economy will worsen over the next six months, up from 65 per cent last week and more than double historical readings for this question. Until last month, the previous high was 57 per cent during the 2008 recession

- The share of Canadians who say their personal finances have worsened over the past year rose to 33 per cent, the highest since 2013

- Unsurprisingly given the layoffs, concern about job security has spiked. Almost one fifth of respondents now say they’re at least somewhat worried about losing work. That’s also the highest since 2013

- The anxiety is spilling over into housing, with 35 per cent of respondents now expecting home prices to decline, the highest degree of pessimism for real estate since 2008

Every week, Nanos Research surveys 250 Canadians for their views on personal finances, job security and their outlook for both the economy and real estate prices. Bloomberg publishes four-week rolling averages of the 1,000 telephone responses.

Polling for the confidence index began in 2008 on a quarterly, then a monthly basis until 2013, when it switched to weekly tracking.