Jan 15, 2024

Meiji Yasuda Life Insurance Will Avoid Japan Sovereign Bonds Until Yields Rise

, Bloomberg News

(Bloomberg) -- Meiji Yasuda Life Insurance Co. will likely wait until yields rise on Japan’s super-long sovereign bonds before it starts buying them again.

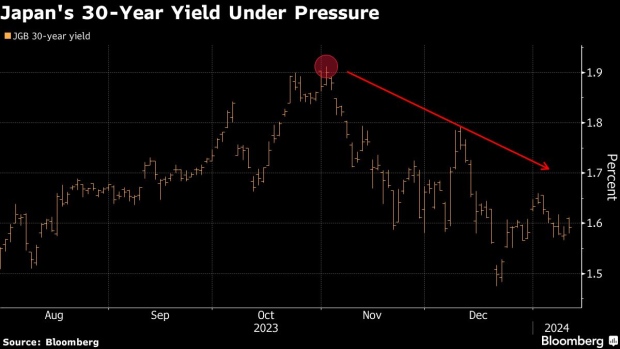

Japanese life insurers are the main buyer of bonds due in more than 10 years and typically increase purchases toward the end of the fiscal year. Investor appetite has been sluggish amid falling yields, with that on benchmark 30-year securities declining to 1.58% on Monday from a decade-high of about 1.9% reached in November.

Speculation about an early interest rate cut by the Federal Reserve has also pressured yields. Additionally, the devastating earthquake that struck Ishikawa Prefecture on Jan. 1 has damped expectations that the Bank of Japan will end the world’s last negative-interest rate in the near future. Swap markets price in about a 5% chance of a rate increase at its meeting in March compared with about 70% a month ago.

“It’s okay to buy them when yields rise as we are not in rush,” said Kenichiro Kitamura, general manager of investment planning and research department at the Japanese insurer with total assets of ¥46 trillion ($316 billion). “If the BOJ won’t do anything, it is also okay for us not to do anything as well,” he said in an interview on Monday.

Meiji Yasuda increased its holdings of yen debt in the first half of fiscal 2023 and indicated in last October’s investment plan that it plans to boost yen debt and non-hedged overseas bond holdings in the second half. However, Kitamura said it’s possible that may not happen.

Meiji Yasuda Plans to Shift More to Non-Hedged Foreign Bonds (1)

“It does not matter if the purchase goes over to next fiscal year,” Kitamura said. “We only buy them when yields rise.”

The company bought foreign sovereign and corporate bonds when the US long-term yield was “high,” allowing Meiji Yasuda to put off more purchases for now, Kitamura said.

The US 10-year yield slumped below 4% on Friday from a 16-year high of more than 5% in October. The US gauge may fall more if Donald Trump wins the presidential election later this year as he is likely to favor lower borrowing costs and a weaker dollar, which would put downward pressure on Japan’s yields as well, Kitamura said.

Kitamura doesn’t expect sub-zero interest rates and yield-curve control to be removed in the near-term. However, “these things will eventually happen,” and the BOJ will buy fewer bonds, which would help boost local yields, he added. Kitamura expects the central bank to end its negative interest rate in April.

In addition, Kitamura said life insurers are “fairly well-positioned” in buying of super-long bonds to comply with upcoming regulations, another indication yields will be on an upward trend in the medium- to long-term.

Sandwiched by these factors, fiscal 2024 is a critical year to judge which force will weigh more on the markets, according to Kitamura. The 10-year yield may temporarily rise to or above 1% and 30-year gauge to near 2%, he said.

The company’s investments are performing positively as equity prices have risen more than expected, the yen remains weak, and hedging costs are falling, he added.

©2024 Bloomberg L.P.