Feb 12, 2020

MGM's longtime CEO Murren to step down; virus weighs on results

, Bloomberg News

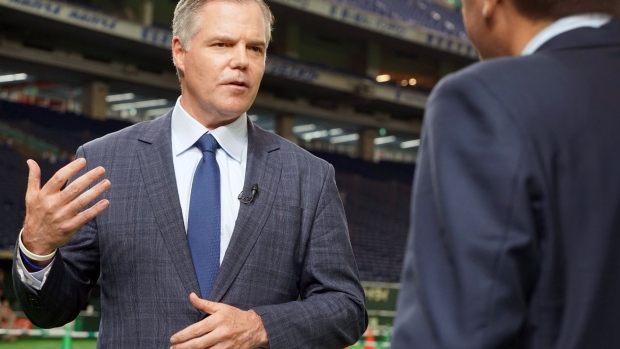

MGM Resorts International’s longtime chairman and chief executive officer, Jim Murren, plans to step down before his contract expires -- departing as the casino company copes with fallout from the deadly coronavirus.

Murren, 58, will remain on the job until a successor is named, the company said Wednesday in a statement. He’s held the post since 2008 and has been with MGM since 1998. On a conference call, Murren said he would remain involved in efforts to win a casino license in Japan.

“Our growth areas of sports betting, Japan and entertainment have never looked better,” he said. “Our bench of management talent is deep.”

Separately, MGM on Wednesday withdrew its earnings forecast for 2020, citing the impact of the virus on its casinos in Macau and Las Vegas. That sent the shares down as much as 5.8% to US$31.70 in extended trading. They were up 1.2% this year through Wednesday’s close in New York.

The company, fresh off the sale of some of its last remaining real estate, said the virus has made its outlook “unpredictable.” To placate investors, MGM announced a US$3 billion share repurchase, including a US$1.25 billion tender offer starting Thursday, and raised its dividend 15%.

Like other casino owners in the Chinese enclave of Macau, MGM Resorts shut its operations there this month under a government order. That’s led to a loss of business -- all while the company has to keep paying staff and maintaining its properties. Last year, MGM got about 27% of its revenue from Macau, the largest gambling market in the world.

Even before the coronavirus hit, business in Macau was already hurting because of the political unrest in Hong Kong and trade tensions between the U.S. and China. Gaming revenue in the region fell 8.4% industrywide in the final three months of 2019.

Baccarat Players

Las Vegas, where MGM is the biggest operator, is also taking a hit as fewer Asian baccarat players travel to the U.S. Profits from those customers were about US$100 million lower in 2019 than they had been the year before, the company told investors.

MGM had previously forecast as much as US$3.9 billion in earnings before interest, taxes, depreciation and amortization for 2020. The company spent about US$10 million in the fourth quarter on its sports-betting business, which includes a joint venture with GVC Holdings Plc. Profitability in that business may not come until 2025, MGM President Bill Hornbuckle said on the call.

The Chinese government closed Macau’s casinos for a 15-day period that began Feb. 5, although Matt Maddox, CEO of rival Wynn Resorts Ltd., told investors last week there’s no certainty as to when they will reopen. Wynn said it is losing about US$2.5 million a day in Macau. MGM put its figure at US$1.5 million a day.

To boost returns, Murren spearheaded MGM Resorts’ “asset light” strategy, by selling its real estate while continuing to operate the properties. Previously announced transactions are expected to bring in net cash proceeds of US$8.2 billion, including the still-to-close sale of the MGM Grand hotel in Las Vegas.

Kerkorian Era

Murren joined the company when it was under the control of founder and billionaire Kirk Kerkorian, who died in 2015, and he was the force behind CityCenter, the massive Las Vegas Strip development that opened in 2009, during the financial crisis. He’s also led the company’s current effort to open a resort in Japan.

In October, the company named Keith Meister, the founder of Corvex Management LP, to its board, an acknowledgment that activist investors have been pressuring the hotel-casino operator to boost returns.

Murren was also was instrumental in bringing professional sports to Las Vegas. He was involved in the building of T-Mobile Arena and bringing the Golden Knights, Aces and Raiders to the city.

An independent board committee is conducting the search for his successor, the company said.

Earnings for the fourth quarter of 2019, excluding some items, totaled 8 cents a share, missing the 25-cent average of analysts’ estimates. The company cited weaker than expected results in Macau and the related softness in Las Vegas. Revenue, at US$3.2 billion, met projections.