Aug 1, 2019

Mike Philbrick's Top Picks: Aug. 1, 2019

BNN Bloomberg

Mike Philbrick's Top Picks

The delivery of BNN Bloomberg’s Market Call newsletter for Thursday Aug. 1 has been delayed due to technical issues. We apologize for the delay.

Mike Philbrick, president of ReSolve Asset Management

Focus: ETFs

MARKET OUTLOOK

ON STRUCTURAL DIVERSIFICATION

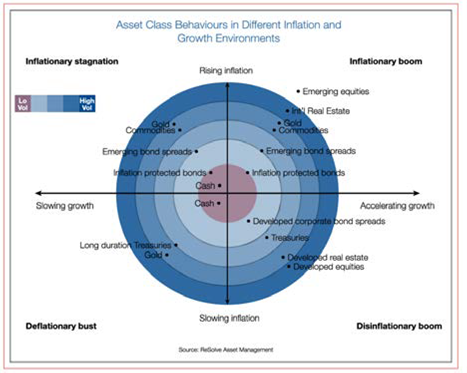

The four economic regimes created by variations in growth and inflation greatly inform whether specific asset classes will thrive or wilt.

The simple idea here is twofold. Firstly, using more diverse asset classes is an important starting point. Investors should be considering all the asset classes above so they own the ones that respond positively as regimes shift through time. Secondly, diversified portfolios ought to have a method to balance the risk allocated to each of these four potential states of the world. That way, an investor will never be caught off guard by a systemic “shock.”

The past quarter century has been characterized by benign inflation and sustained growth in the global economy. These qualities favoured traditional portfolios of developed market stocks and bonds, such as the ubiquitous 60/40 “balanced” portfolio. However, truly diversified portfolios must be prepared to weather periods of poor global growth, potentially accompanied by large swings in inflation, when both stocks and bonds may flounder. The 1970s offer a meaningful case study, as stagnating economic growth coupled with high and accelerating inflation produced negative real returns for stocks and bond. Holding gold, commodities and, in contemporary markets, Treasury inflation-protected securities (TIPS), would have provided a ballast to offset the losses from stocks and bonds. As such, a more diversified portfolio would have generated reasonable returns during this otherwise “lost” decade.

Why is this particularly important now? Well, it’s always important, but more so today as slowing global growth, increasing trade tensions and changing inflation expectations point to a possible shift in regime where asset classes that thrive in more hostile environments (the 1970s example above) maybe be underrepresented in investor portfolios.

TOP PICKS

HORIZONS GOLD ETF (HUG.TO)

This ETF seeks investment results corresponding to the price of gold via the futures markets and returns are hedged back to the Canadian dollar. Management expense ratio (MER) is 0.65 per cent.

HORIZONS ALPHAPRO ENHANCED INCOME GOLD PRODUCERS ETF (HEP.TO)

This ETF holds a portfolio holding 15 equally-weighted senior global gold and silver producers and writes at or near the money listed call options against security positions. Option premiums and dividends earned by the fund are distributed to unit holders on a monthly basis. The strategy is enhanced by high implied volatilities on the call options of senior gold producer stocks. MER is 0.65 per cent.

WISDOMTREE EMERGING MARKETS CORPORATE BOND ETF (EMCB.OQ)

This ETF invest in debt of emerging markets corporate issuers. Its fixed income portfolio has investments in globally-operating companies headquartered in emerging markets and issuing debt in U.S. dollars. It offers attractive income and total return in U.S. dollars.

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| HUG | N | N | N |

| HEP | N | N | N |

| EMCB | N | N | N |

PAST PICKS: JULY 30, 2018

ISHARES MSCI CHINA A ETF (CNYA.N)

- Then: $27.20

- Now: $27.24

- Return: 1%

- Total return: 4%

HORIZONS ENHANCED INCOME INTERNATIONAL EQUITY ETF (HEJ.TO)

- Then: $6.40

- Now: $5.69

- Return: -11%

- Total return: -5%

ISHARES U.S. REAL ESTATE ETF (IYR.N)

- Then: $79.88

- Now: $89.30

- Return: 12%

- Total Return: 15%

Total return average: 5%

| DISCLOSURE | PERSONAL | FAMILY | PORTFOLIO/FUND |

|---|---|---|---|

| CNYA | N | N | N |

| HEJ | N | N | N |

| IYR | N | N | Y |

Company Twitter Handle: @investresolve

Personal Twitter Handle: @MikePhilbrick99

Website: www.investresolve.com

Blog: https://investresolve.com/blog/

Other: https://riskparity.ca/