Dec 13, 2022

Morgan Stanley Says Hedge China Reopening Trades on Growth Woes

, Bloomberg News

(Bloomberg) -- A sharp increase in China’s Covid infections following an abrupt end to strict pandemic control measures suggests investors may need to pare back on reopening trades, according to Morgan Stanley.

“We would recommend that investors put on hedges in the markets where investors are almost fully pricing in reopening trades,” strategists including Min Dai and Gek Teng Khoo wrote in a note. China’s rates market falls in that category as growth is expected to slow in the coming weeks and months, prompting the central bank to remain dovish.

The bank’s latest view marks a rethink of its recommendation in early November to add trades that could benefit from China easing its Covid Zero policy. “It is possible that the market will look through short-term disruption and keep an eye on the end-game, which we maintain will be a reopened Chinese economy,” it said, adding that if Covid cases spiral quickly the market could price in some additional risk premium in the rest of emerging markets.

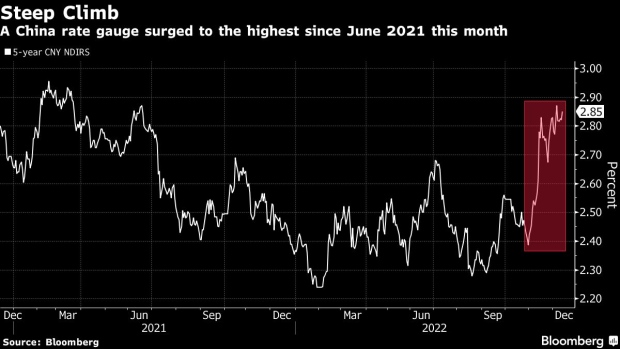

Wagers on a reopening-led economic rebound pushed China’s five-year non-deliverable interest rate swaps 44 basis points higher in November, the steepest monthly rise since 2016. It advanced to as high as 2.91% last week, before easing to around 2.8%.

China’s five-year NDIRS shows “the market is pricing in 25 basis points of rate hikes by the PBOC in the next 12 months, which is excessive, in our view,” they wrote, “the growth slowdown to be expected in the next few weeks or months would prompt the PBOC to stay on the dovish side, which would push China rates lower.”

Baidu searches for ‘fever’ and subway travel data show that cases are spiking in Beijing and people are reluctant to go out, according to the note. Data released Monday also showed credit expanded at a slightly slower pace than expected in November despite the PBOC’s efforts to boost lending and ease restrictions on property loans.

Read: End of Covid Zero Risks Overwhelming China With Infections (1)

Morgan Stanley strategists recommend receiving China’s five-year NDIRS, a trade that would benefit benefit as rates fall. The bank closed paying five-year NDIRS trade when it hit 2.85%. They also remain bullish on the yuan as they see weak consumption and imports supporting the currency, with exporters converting more foreign currencies following the yuan’s advance.

--With assistance from Sofia Horta e Costa.

©2022 Bloomberg L.P.