Jul 30, 2020

Nasdaq's US$4-trillion rally set to heat up on tech earnings sweep

, Bloomberg News

Anti-trust hearing might 'mark the beginning of the end of big tech': Scott Galloway

The already blistering rally in U.S. technology companies is about to intensify after earnings from the biggest purveyors of internet services and smartphones blew past estimates.

Exchange-traded funds tracking the Nasdaq 100 jumped about 1.8 per cent following results from Amazon.com Inc., Facebook Inc., Alphabet Inc. and Apple Inc. that showed business was mostly thriving amid the coronavirus lockdown. A fund tracking the S&P 500 rose 0.8 per cent.

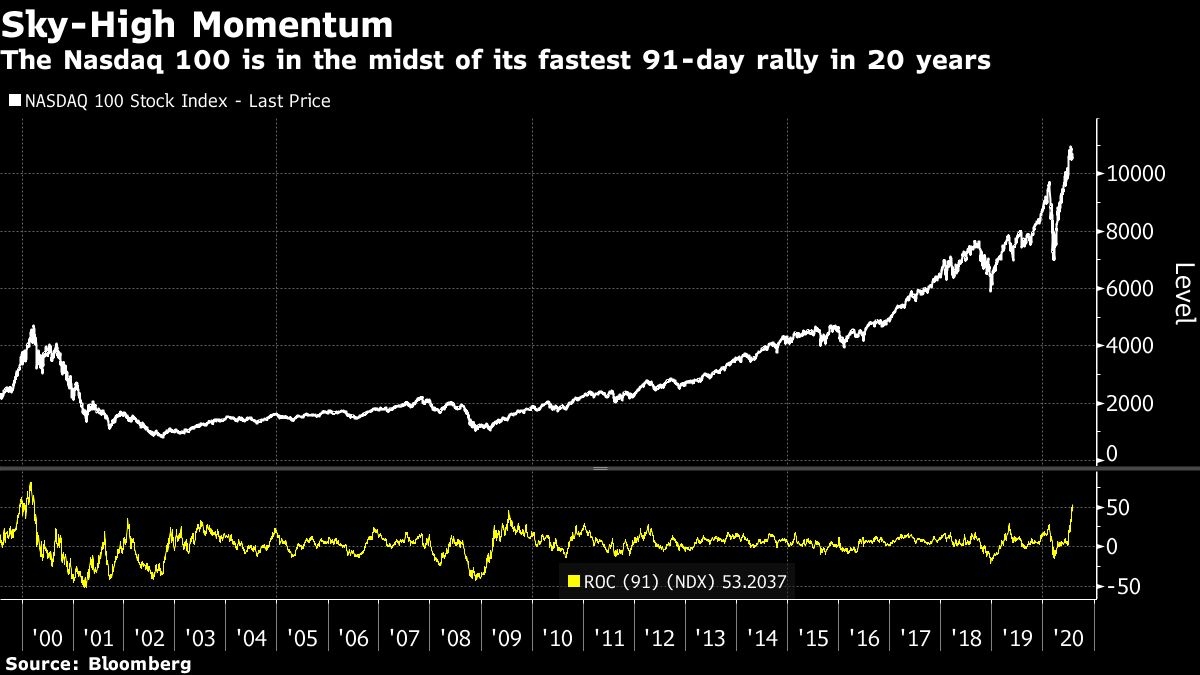

Even before the results hit, the Nasdaq 100 had surged 53 per cent in the 91 days since the benchmark bottomed on March 20, the fastest rally over any comparable time period since 2000. Two decades ago during the dot-com bubble, a 91-day rally for the tech-heavy index reached 80 per cent.

“I was extraordinarily impressed by the beats. Hard not to be,” said Michael Purves, chief executive officer of Tallbacken Capital Advisors. “It’s night and day compared to 1999. It was not about earnings then, it was all about the future, the expectations.”

Facebook climbed five per cent after the social media company’s second-quarter sales topped analysts’ highest estimates, showing signs of recovery from the pandemic’s disruption to its digital-advertising business. Amazon advanced about five per cent after the online giant reported profit that far exceeded analysts’ estimates, showing that the e-commerce giant can make money despite spending heavily to keep operating through the COVID-19 pandemic.

The results are validation for bulls who have bet the tech giants would emerge from the pandemic stronger than the rest of the market. Since the bottom in March, the Nasdaq 100 has added about US$4 trillion in market value. The index is poised to beat the S&P 500 for a 10th straight month, the longest winning streak in 20 years, thanks to solid balance sheets and products that cater to social distancing.

Before Thursday, the tech industry had been off to a middling start this earnings season — at least as far as their stocks were concerned. Among firms that reported, more than 90 per cent exceeded profit forecasts, but their shares fell an average one per cent on the first day, the second-worst reaction among the 11 main industries, data compiled by Bloomberg show. Given how hard it’s been for bad economic news to hurt the group, the culprit would seem to be valuations, which at 33 times income are double levels just 18 months ago.

But Thursday’s earnings suggested some of the angst over bubble valuations was overblown. Apple reported quarterly revenue that crushed Wall Street forecasts after locked down consumers snapped up new iPhones, iPads and Mac computers to stay connected during the pandemic. The stock jumped almost five per cent.

Alphabet’s first drop in revenue in at least a decade wasn’t as bad as analysts expected as advertisers ravaged by the coronavirus pandemic relied on the internet giant to connect with people stuck at home. Its shares were up almost one per cent.