Aug 3, 2022

Natural Gas Surges With US LNG Export Terminal Set for Fast Restart

, Bloomberg News

(Bloomberg) -- US natural gas prices surged after a key export terminal in Texas reached an agreement with regulators to resume exports as soon as October after an explosion.

Freeport LNG, which was shut down in June after a blast, has entered into an agreement with the Pipeline and Hazardous Materials Safety Administration to restart operations in early October at almost full capacity, the operator said in a emailed statement. That would boost demand for natural gas by nearly 2 billion cubic feet a day, equivalent to roughly 2% of domestic output.

While Freeport had already indicated that it planned to resume operations in October, the news surprised traders who expected a more gradual restart after PHMSA, as the regulator is known, demanded a series of corrective actions from Freeport.

“The partial restart is bigger than previously expected,” said Brayton Tom, a senior risk manager for energy at StoneX Group Inc.

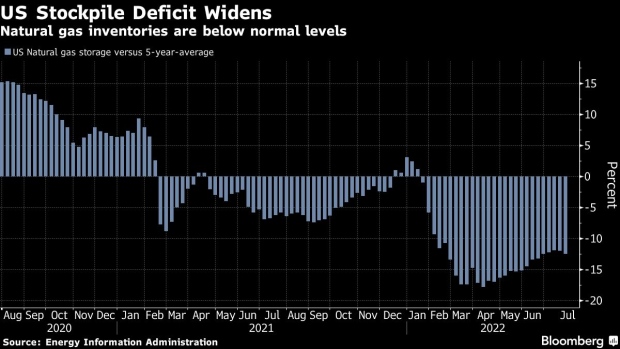

The restart of Freeport LNG is poised to increase the strain on US inventories of the heating and power-generation fuel ahead of winter. Concern about tightly supply has triggered stomach-churning volatility and led prices to more than double this year. Gas held in salt caverns and depleted aquifers is about 12% below levels typically seen for this time of the year, and booming domestic demand this summer has limited suppliers’ ability to add gas to storage.

“We previously had Freeport only returning to partial service in November, and the extra feedgas demand that is likely puts longer odds on the bearish side of the market,” said David Seduski, an analyst at Energy Aspects Ltd.

The restart of Freeport LNG should come as a relief for Europe, which desperately needs extra US gas. Reduced imports from Russia amid the war in Ukraine have sparked fears of a supply crunch this winter, sending prices in the region skyrocketing.

Gas for August delivery on the New York Mercantile Exchange settled up 7.3% at $8.266 per million British thermal units after earlier rising as much as 10%.

©2022 Bloomberg L.P.