Mar 23, 2023

New Fed Forecasts Suggest Central Bank Is Bracing for Recession

, Bloomberg News

(Bloomberg) -- Federal Reserve Chair Jerome Powell and his colleagues are expecting a sharp dropoff in economic activity through the rest of 2023 — at least, that’s the implication from new economic projections they published this week.

The figures show policymakers now expect the US to eke out a 0.4% expansion this year, down from the 0.5% growth rate they penciled in at the last forecast round in December.

That might not seem like a big downgrade at first blush. But it’s important to consider that number in light of the economy’s surprising strength in the first quarter so far, as Robin Brooks, the chief economist at the International Institute of Finance in Washington, points out.

In January, the Atlanta Fed’s GDPNow tracker forecast first-quarter gross domestic product would rise 0.7% at an annualized rate. By March 16, that estimate had risen to 3.2%.

Fed policymakers don’t release official projections for quarterly growth. But taking the latest estimates from private forecasters and Fed economists into account, the new projections imply Fed officials see a sharper downward trajectory for quarters two through four.

As Brooks put it, “The Fed is bracing for recession.”

Based on current first-quarter forecasts, the Fed’s latest projections imply GDP will shrink by 0.2% on average per quarter through the rest of the year, Jason Furman, a former top White House economist, said on Twitter. That’s compared with the 0.5% average growth over those three quarters implied by the Fed’s December forecast.

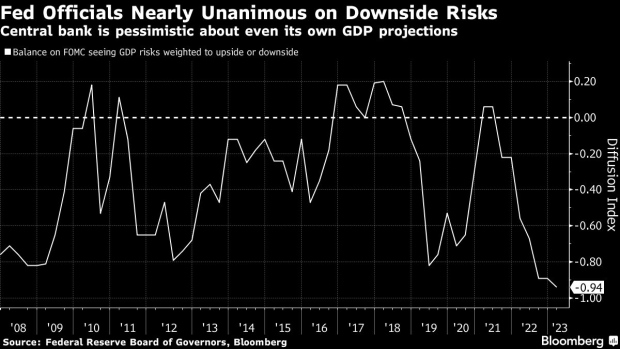

To make matters worse, nearly all Fed officials saw risks to that already-downgraded forecast as tilted to the downside. And they’ve never been in greater agreement on that point, according to data compiled by Bloomberg that stretches back to 2007.

©2023 Bloomberg L.P.