Nov 1, 2022

New Zealand House Prices Suffer First Annual Decline in 11 Years

, Bloomberg News

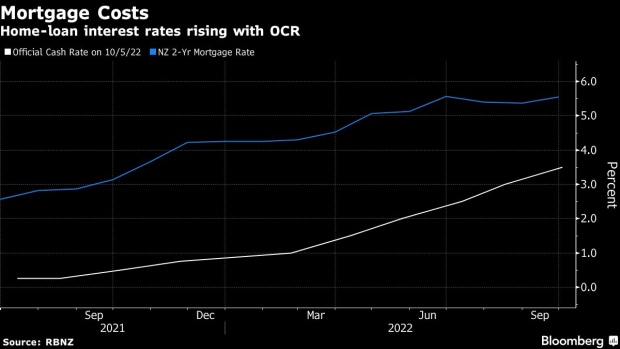

(Bloomberg) -- New Zealand house prices suffered their first annual decline in more than 11 years in October as surging home-loan interest rates discouraged buyers.

Prices fell 0.6% from a year earlier, the first year-on-year drop since June 2011, CoreLogic New Zealand said Wednesday in Wellington. Values fell for a seventh consecutive month, sliding 1.3% from September.

“Stretched affordability is constraining the ability and willingness of all buyers to get or extend a mortgage,” said CoreLogic Head of Research Nick Goodall. “This all leads to reduced demand and contributes to falling prices.”

The Reserve Bank has increased the Official Cash Rate by 3.25 percentage points to 3.5% over the past year and some economists forecast the benchmark could go to 5% or higher in 2023. Trading banks have lifted home-loan interest rates to match the aggressive tightening cycle, and CoreLogic expects mortgage interest rates to keep rising.

Goodall said the variable interest rate averaged 7.1% at the end of October but at least one main bank uses an 8% assumption to test whether a customer can service a loan, and that test rate could rise to 8.5% if the OCR climbs even higher next year.

Economists are predicting house prices will fall about 13% this year and decline further in 2023, with a peak-to-trough slump in the market of 18-20% forecast.

Goodall said the impact of the RBNZ’s aggressive rate increases on property values and the broader economy may give the central cause to rethink.

“For now, the impact has been manageable and limited, but with each OCR hike comes a heightened risk of a deeper and longer recession, and with it growing unemployment and financial stress,” he said.

(updates chart)

©2022 Bloomberg L.P.