Apr 3, 2024

NYC Pensions Reach Deal With RBC to Publish Green-Funding Ratio

, Bloomberg News

(Bloomberg) -- New York City retirement plans reached an agreement with Royal Bank of Canada for the lender to disclose how much financing it provides for clean-energy projects relative to fossil fuels.

Canada’s largest bank is the third financial giant to agree to begin disclosing the ratio after New York Comptroller Brad Lander and the city’s public-pension boards filed shareholder resolutions with six banks in January. The proposal was set to be voted upon at Toronto-based Royal Bank’s annual meeting next week.

“We’re thrilled that they’ve adopted it,” Lander said in an interview Wednesday. “We expect this will become a standard part of what banks disclose and we hope the others will follow suit promptly.”

Royal Bank plans to report a clean-energy supply financing ratio in its 2024 climate report — a disclosure that “aligns to our strategic objectives.” Jennifer Livingstone, Royal Bank’s vice president of climate, said in an emailed statement.

“Transparency and advanced disclosures on climate performance are critical to showing the progress we are making,” she said. “We appreciate the constructive dialog that we have had” with Lander’s office “and plan to engage with them and industry partners in developing the ratio.”

The agreement with Royal Bank follows similar pacts with New York-based JPMorgan Chase & Co. and Citigroup Inc., which both agreed to the disclosures last month. Val Smith, Citigroup’s chief sustainability officer, said in a separate statement that the bank plans to include the metric as an addition to other disclosures provided in its climate reporting.

Outstanding Resolutions

Lander’s office still has outstanding resolutions filed with Bank of America Corp., Goldman Sachs Group Inc. and Morgan Stanley, it said.

“What we like about these ratios is that they get at both sides of the equation,” Lander said, noting that while many lenders have scaled up green investments, financing for oil and gas and other energy projects has also risen or remained high in many cases.

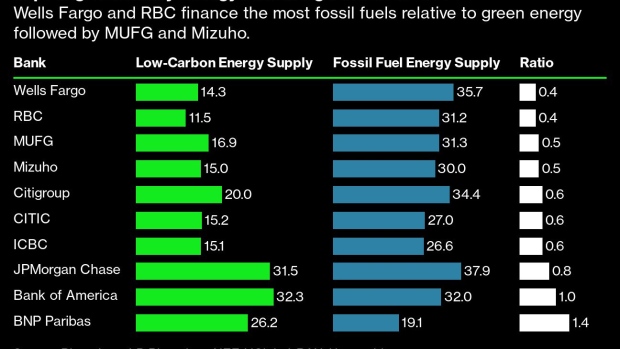

Researchers at BloombergNEF have been tracking the ratio of funding committed to low-carbon infrastructure relative to fossil fuels and say it needs to reach 4 to 1 by 2030 to help the world avoid the worst consequences of global warming. At the end of 2022, the global average of that ratio stood at 0.73 to 1, according to a BNEF report in December, meaning for every dollar in bank-facilitated financing of fossil fuels, 73 cents supported low-carbon energy projects.

The banks themselves have additional data on private transactions and direct lending that BNEF is unable to include in its measurements, Trina White, a sustainable-finance analyst with the group, said in a blog post in late March.

Royal Bank has recently shown progress on green lending that “we hadn’t seen before,” said Jamie Statter, senior adviser on climate in the New York comptroller’s office. The lender said in its most recent climate report, published in March, that it would triple its annual financing of renewable-energy projects to C$15 billion ($11.1 billion) by 2030 and increase its overall low-carbon lending to C$35 billion by that year.

“They were initially open to the discussions around the ratio,” Statter said, adding that while Royal Bank said it would prefer to see a industry standard for the metric, it was willing to move forward now without that.

New York City’s pension funds have faced criticism, including a lawsuit last year, from conservative groups for their support of environmental, social and governance measures.

Lander said Wednesday that recognizing the financial risks posed by climate change is consistent with the pension plans’ role as a long-term, universal investor.

Read More: Canada’s RBC Struggles to Go Green While Financing Oil

(Updates with comment from Citigroup in sixth paragraph.)

©2024 Bloomberg L.P.