Jul 13, 2023

Office Demand Shows Signs of ‘Meaningful Improvement’ in US

, Bloomberg News

(Bloomberg) -- Office demand is starting to show early signs of stabilizing in the US.

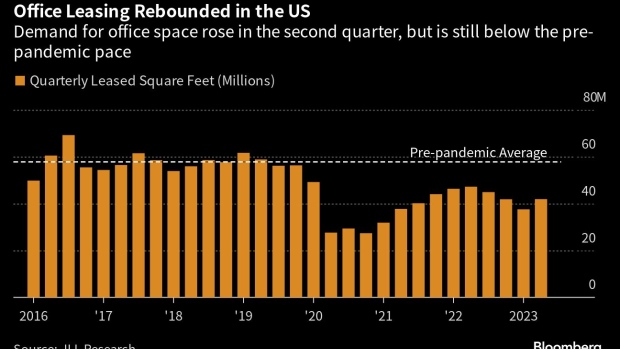

Leasing rebounded 7.7% in the second quarter from the first three months of the year, according to Jones Lang LaSalle Inc. Demand increased for growing industries, such as energy companies in Texas, and as more large tenants signed contracts for new space, according to JLL’s Jacob Rowden.

“It’s a meaningful improvement,” Rowden, head of US office research for the brokerage, said in an interview. “But it’s too early to say this is a launch point of a sustained recovery.”

The leasing gains are a welcome sign for a sector that’s been battered in recent years. The rise in remote work, as well as layoffs, spurred companies to cut back on office space, leaving many landlords facing dismal prospects. That’s weighed on valuations with office prices down 31% from a 2022 peak, according to Green Street.

The office market is still under pressure. The 40.4 million square feet (3.75 million square meters) of space leased in the second quarter was down 14% from the same period a year ago and below a pre-pandemic average.

More office space also became available for rent during the period, pushing the vacancy rate up to nearly 21%. Tenants renewing leases or moving are typically reserving about 20% less space for desks, although that’s partially offset by demand for more meeting rooms, Rowden said.

Still, promising signs emerged in the second quarter with tenants increasingly searching for spaces greater than 100,000 square feet, Rowden said. Technology companies, which had been putting up a large amount of space to be subleased, also slowed that down, helping the market.

“We’re seeing green shoots,” he said. “The macro picture is generally improving.”

Office market changes varied vastly by geography. Asking rents rose 7.3% in Miami and nearly 18% in West Palm Beach from a quarter earlier as companies continued to demand space in South Florida.

New York has benefited from its culture of in-person office work and from a diverse mix of industries wanting space in the city, Rowden said. Sublease space declined in the second quarter while overall vacancies increased as 3.9 million square feet of new inventory opened, including Two Manhattan West, developed by Brookfield Corp. near Hudson Yards, and offices in Google’s newly renovated building at 550 Washington St.

In San Francisco — a market battered by job cuts, remote work and pullbacks from technology firms — the office availability rate, which includes vacant and sublease space, reached 34% of total inventory. The vacancy rate is unlikely to start shrinking until at least 2024, Rowden said. But the city is starting to see more demand coming from artificial intelligence companies.

©2023 Bloomberg L.P.