Apr 5, 2022

Crude advance holds as EU sanctions on Russia avoid oil for now

, Bloomberg News

Oil Extends Gains as EU Works on New Russia Sanctions

Oil held its earlier gains as the European Union was said to plan a phaseout of Russian coal imports but steer clear of sanctioning the country’s oil and gas for now.

West Texas Intermediate was up 1.2 per cent after earlier advancing as much as 2.2 per cent. EU nations are deeply split over the next steps to take against Russia, and some governments are continuing to push for at least a signal this week that the bloc is looking to reduce Russian oil imports, a person familiar with the matter said.

The European Commission is also expected to propose banning most Russian trucks and ships from entering the EU, according to people familiar.

Oil rallied to the highest level since 2008 in the first quarter as Russia’s invasion disrupted supplies in an already tight market faced with roaring demand and dwindling stockpiles. The U.S. and U.K. have already moved to ban Russian oil, and mounting civilian casualties in Ukraine are piling pressure on governments to take further steps against Russia.

The “EU and the U.S. have been struggling with Russian energy exports,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “They want to sanction Russian energy, but the market needs the energy and the EU especially so with respect to natural gas and oil products.”

With the war in Ukraine in its second month, Russia faces allegations its troops massacred civilians in Bucha and other towns, a charge Moscow denies.

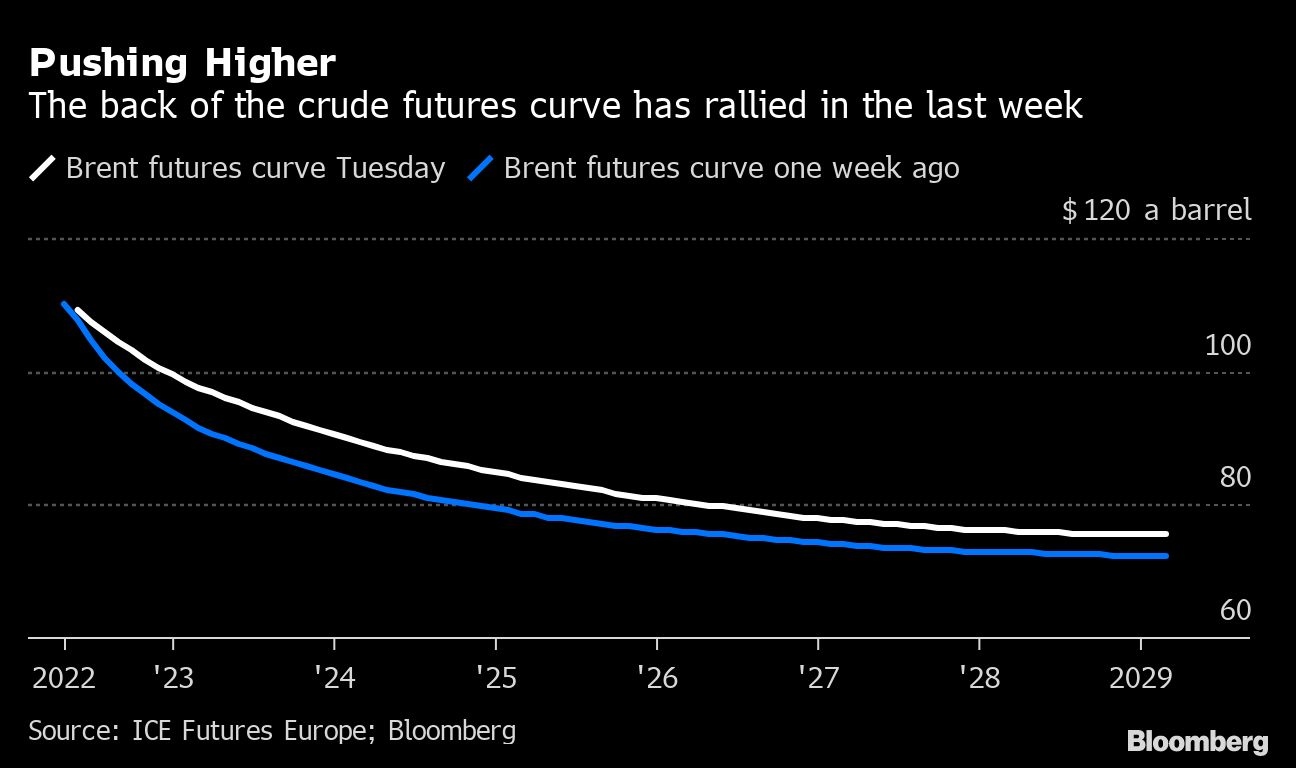

The possibility of new curbs is offsetting the impact in the global crude market of a vast release from the U.S. strategic petroleum reserves, beginning in May, in a bid to tame prices. Other countries have said that they’ll also make drawdowns. That move has reshaped the oil futures curve, keeping a lid on nearby prices but lifting those further into the future.

Demand for cargoes from the Middle East is also rising as buyers shun Russia. In a further sign of tightness, Saudi Arabia has raised prices for all regions. Saudi Aramco increased its Arab Light crude for next month’s shipments to Asia to US$9.35 a barrel above the benchmark it uses, a record differential.

Many western companies aren’t taking Russian crude, although discounted exports are going to buyers in Asia, including China and India. On Monday, commodity trader Trafigura Group offered to sell a cargo of Russia’s Urals grade at a record discount, but there were no bids for the shipment.

Prices:

- West Texas Intermediate for May delivery advanced 1.2 per cent to US$104.51 a barrel by 11:51 a.m. in London.

- Brent for June settlement climbed 1 per cent to US$108.68 a barrel.