Aug 3, 2020

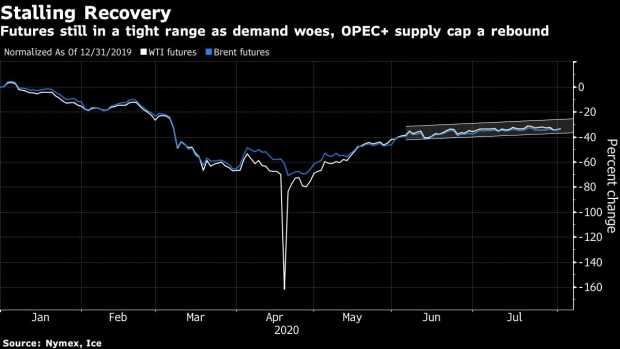

Oil Rally Pauses as More OPEC Supply Offsets Economic Cheer

, Bloomberg News

(Bloomberg) -- Oil’s rally stuttered in Asia with the prospect of higher OPEC+ output in August keeping gains in check despite signs of an economic recovery.

Futures in New York fell 0.7%, after gaining 1.8% on Monday. The OPEC+ producer bloc will pump about 1.5 million barrels a day more in August than in July. Tapering of historic output curbs looks to have already begun: Russia lifted its production slightly in July, while a Bloomberg survey showed that Saudi Arabia, the United Arab Emirates and Kuwait phased out extra supply cutbacks last month.

Crude tracked strong gains in equities on Monday after data showed U.S. manufacturing expanded in July at the fastest pace since March 2019. There was also positive news from the euro area, where factories posted their first expansion in one-and-a-half years, and China, with a private gauge showing the country’s factory activity grew at a faster pace in July than at any point since January 2011.

A fresh shot of stimulus in the U.S. may improve the demand outlook, but Democrats and Republicans remain at an impasse over a virus relief bill. President Donald Trump said on Monday that he may take executive action to impose a moratorium on evictions with talks on a new virus relief plan stalled in Congress. The White House is also exploring whether the president can act on his own to extend enhanced unemployment insurance payments.

Indian sales of diesel -- the lifeblood of the Asian giant’s economy -- appear to have fallen sharply last month as several provinces imposed small-scale lockdowns to curb record daily infection rates.

©2020 Bloomberg L.P.