Nov 9, 2018

Oil's losing streak hits record 10th day

, Bloomberg News

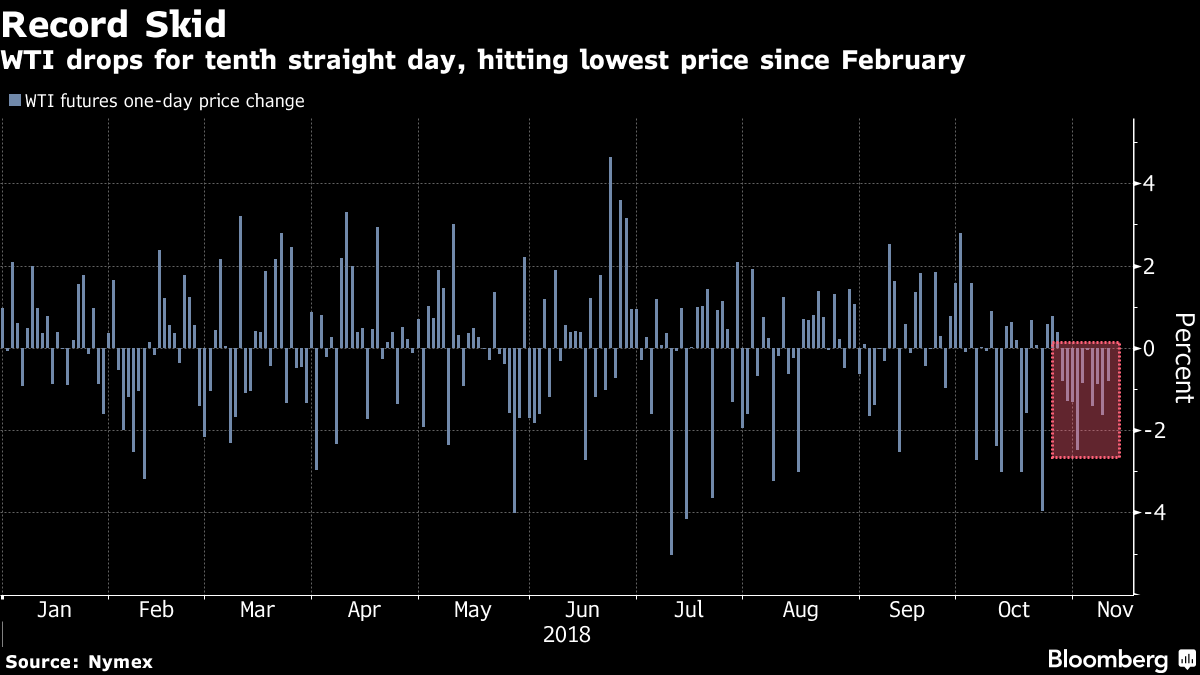

U.S. oil prices fell for a 10th consecutive day, the longest losing streak on record.

Futures in New York tumbled 0.8 per cent to settle at US$60.19 a barrel. West Texas Intermediate crude earlier this week fell into a bear market on concerns supplies are going to overwhelm the market, as the U.S. offered nations waivers to continue buying Iranian oil.

U.S. oil has given up all its gains for the year. The record run of declines in U.S. oil prices will push OPEC and its allies into a corner as they meet this weekend. OPEC ministers and allies are gathering in Abu Dhabi in a highly-anticipated meeting that could yield a decision on future supply cuts.

“The Iranian sanctions were supposed to be a game-changer in the market,” said Michael Loewen, a commodities strategist at Scotiabank in Toronto. Producers have been “attempting to pump as much oil as possible right now to soften the blow of those Iranian sanctions, yet Trump comes out and gives waivers.”

Crude’s super slump from its early-October peak above US$76 a barrel comes as U.S. production is at a record, OPEC output is at the highest since 2016 and more Iranian crude might make it to market then previously thought.

A measure of oil market volatility is at the highest since late 2016.

A potential agreement by OPEC to return to output cuts would mark the second production U-turn for the group this year. For Saudi Arabia -- the world’s biggest crude exporter -- it would be the third time in recent years that the kingdom has delivered a supply surge only to quickly reverse it.