Apr 12, 2022

Oil tops US$100 as Putin vows to advance war, China eases lockdown

, Bloomberg News

Oil is experiencing biggest realignment in global supply since 1970s: Randy Ollenberger

Oil rallied as Russian President Vladimir Putin vowed to continue the invasion of Ukraine and China partially eased COVID-related restrictions, allaying some of the demand concerns that had weighed on prices.

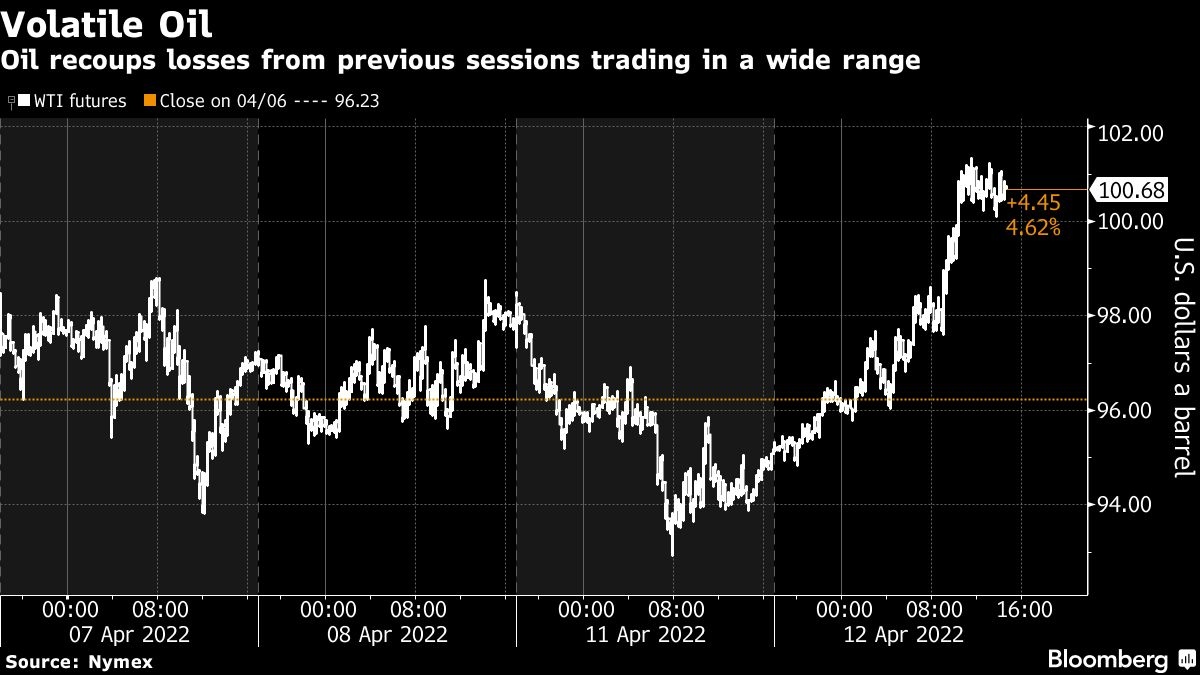

West Texas Intermediate jumped 6.7 per cent to settle above US$100 a barrel, recouping losses from the previous week, as volatility rose. Shanghai has eased lockdowns for some housing complexes, but most people remained confined to their homes. Authorities have indicated they will reimpose restrictions if virus cases climb. Meanwhile, the Russian president said peace talks with Ukraine are “at a dead end.”

“The crude correction appears to be over as China begins to lift some of their lockdowns,” said Ed Moya, senior market analyst at Oanda. “The energy market has now mostly priced in the coordinated strategic petroleum release and probably was overly pessimistic on how far China would stick to their strict lockdown and isolation measures.”

The Energy Information Administration added more bullish sentiment by lowering its forecast for U.S. crude output growth in 2022 and 2023 as shale producers grapple with higher production and labor costs. The agency also revised its demand growth outlook lower as higher fuel prices dampen consumption.

Even with the recent gains, the oil market’s structure has softened markedly in recent weeks. Concerns over supply have eased with some Russian barrels finding their way into the market. U.S. crude for immediate delivery this week sank to trade just 30 cents above the next month, after trading as high as US$5.26 a barrel last month. A planned release of emergency reserves and China’s demand worries have helped calm prices, and pressured differentials for supplies from the Middle East to West Africa.

Prices

- WTI for May delivery rose US$6.31 to settle at US$100.60 a barrel in New York

- Brent for June settlement gained US$6.16 to US$104.64 a barrel.

The oil market has seen a tumultuous period of trading since late February, moving in a range of more than US$5 for the majority of sessions. The spike in volatility spurred a liquidity crunch as exchanges hiked their margin requirements, though some of that move is now reversing with CME Group Inc. cutting margins for WTI by almost 8 per cent.

Related news:

- Americans are expected to drive more this summer than they did last year, even with higher prices limiting some travel.

- President Joe Biden will allow expanded sales of higher-ethanol gasoline this summer in an effort to lower fuel prices and counter the political blowback from them.

- A wave of emergency oil supplies are set to hit the U.S. starting in May and threatens to turn the market on its head, going from severely undersupplied to oversupplied in a matter of months.