Oct 25, 2022

Old Boys' Club at Hong Kong Banking Summit Puts Women on Sidelines

, Bloomberg News

(Bloomberg) -- As pandemic restrictions lift, indoor performances and dancing are back in Hong Kong. So is the finance world’s old boys club.

Goldman Sachs Group Inc.’s David Solomon and Morgan Stanley’s James Gorman are set to join 25 other male speakers at the Global Financial Leaders’ Investment Summit, part of a slate of events signaling the resurrection of the financial hub after almost three years of strict Covid quarantines and a political crackdown by Beijing.

There are just four women in the lineup. Two -- Amundi SA’s Valérie Baudson and Citigroup Inc.’s Jane Fraser -- will be part of a panel on sustainable finance. BNY Mellon Investment Management’s Hanneke Smits will join a discussion on managing money in volatile markets. Laura Cha, the chair of Hong Kong Exchanges and Clearing Ltd., will make welcome remarks on the event’s final day.

The sessions about navigating and creating value through uncertain times and how technology is reshaping the future of finance will feature men only, as will the keynote addresses and fireside chat.

“How is it that in this day and age, 87% of the speakers at the conference are men?” Utpal Bhattacharya, a professor of finance at the Hong Kong University of Science and Technology, said in an interview. With this summit, he said, the “good news is that Asia’s financial hub will be humming again. The bad news is that this hub will continue to be male-dominated.”

Nearly half of the speakers come from US financial firms, where women hold roughly one in three C-suite roles. In Hong Kong’s financial sector, women make up more than half of entry-level positions, and one-third of senior management positions, according to research by PwC.

Among the one-third is Hang Seng Bank Ltd. Chief Executive Diana Cesar, who was previously CEO at HSBC Hong Kong. In 2020, Cesar and 15 other female leaders released an International Women’s Day video pledging to boost gender equality in finance. “Why wait?” she asked. “We can make a world without prejudice.”

Two years on, she and others in the clip, including Mary Huen, CEO of Standard Chartered (Hong Kong) and Amy Lo, Chief Executive of UBS Hong Kong, are absent from the summit’s line up. Standard Chartered Plc. CEO Bill Winters and UBS Group AG chair Colm Kelleher are both speakers.

Standard Chartered, Hang Seng and UBS didn’t respond to Bloomberg’s requests for comment, along with Goldman Sachs, Amundi, BNY Mellon and the Hong Kong Exchange. Citigroup and Morgan Stanley declined to comment.

“We are pleased to see a strong line-up of speakers at group chairman or CEO level to share their global perspectives,” organizer Hong Kong Monetary Authority wrote in an email. “The speaking arrangement is a result of discussions with potential speakers having regard to their availability and subject preference.”

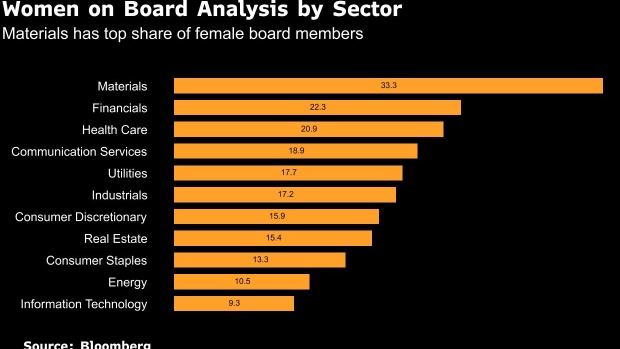

Read more: Women Make Gains on Bank Boards, But Men Still Hold the Power

The landscape in Hong Kong is changing, though. New stock exchange rules for instance require at least one woman on boards of listed companies. That will create more than 1,300 director positions exclusively for women by the end of 2024.

Cesar’s bank has the highest proportion of women on boards among Hong Kong’s blue chip companies, at two thirds. That compares with an average of 17% for members of the benchmark Hang Seng Index in the third quarter of 2022, according to data compiled by Bloomberg News.

“In business schools, the gender ratio is 1:1; so why are those who rise to the top of the finance world disproportionately male?” said Bhattacharya, who also researches gender issues. “The problem is not with the education system, it’s after they graduate.”

Women held five more seats on the boards of companies in the Hang Seng Index in the third quarter from the previous three-month period, according to data compiled by Bloomberg. The average number of female directors rose to 1.9 from 1.8, out of an average board size of 11.1.

- The percentage of female directorships increased to 17.1% from 16.5%

- That is above the 14.6% of the Nikkei 225 in Asia and below the 35.3% of women on boards of the S&P/ASX 200 in Australia, 31.9% of the S&P 500 in the U.S. and 38.8% of the Stoxx 600 in Europe

- Eight Hang Seng companies increased the number of women on their boards; the top companies by market capitalization were Tencent Holdings Ltd., Alibaba Group Holding Ltd. and China Shenhua Energy Co.

- China Shenhua no longer has an all-male board

- Two companies reduced the number of female directors: Bank of China Ltd. and Haidilao International Holding Ltd.

- Hang Seng Bank Ltd. has the highest percentage of women on its board

- The communication services sector led the net gain in female board members, with one woman added to the boards at Tencent Holdings Ltd. and NetEase Inc.

- NetEase Inc. surpassed 30% female board membership for the first time since at least January 2019. The number of Hang Seng companies above this key threshold was 10 in September from eight the previous quarter

- Eight companies, including Meituan, BYD Co. and Baidu Inc., do not have any female board members

- The Bloomberg Gender-Equality Index returned -8.3% in the third quarter, underperforming the MSCI World Index, which returned -6.1%

Hang Seng companies with the highest and lowest percentage of female board members:

The Bloomberg Gender-Equality Index is a modified capitalization-weighted index that tracks the financial performance of those companies committed to supporting gender equality through policy development, representation and transparency.

To see the percentage of women on a company board: FA ESGG

To see more on Bloomberg Gender-Equality Index: GEI

To see more on Bloomberg’s ESG fields and sustainable finance solutions: BESG

--With assistance from Denise Wee.

©2022 Bloomberg L.P.