Feb 2, 2022

OPEC+ agrees on another gradual oil-output hike for March

, Bloomberg News

OPEC+ agrees to modest hike in March

OPEC and its allies agreed to revive more halted oil production, yet the group’s increasingly obvious struggles to fulfill its supply pledges left markets fearful of a potential shortfall.

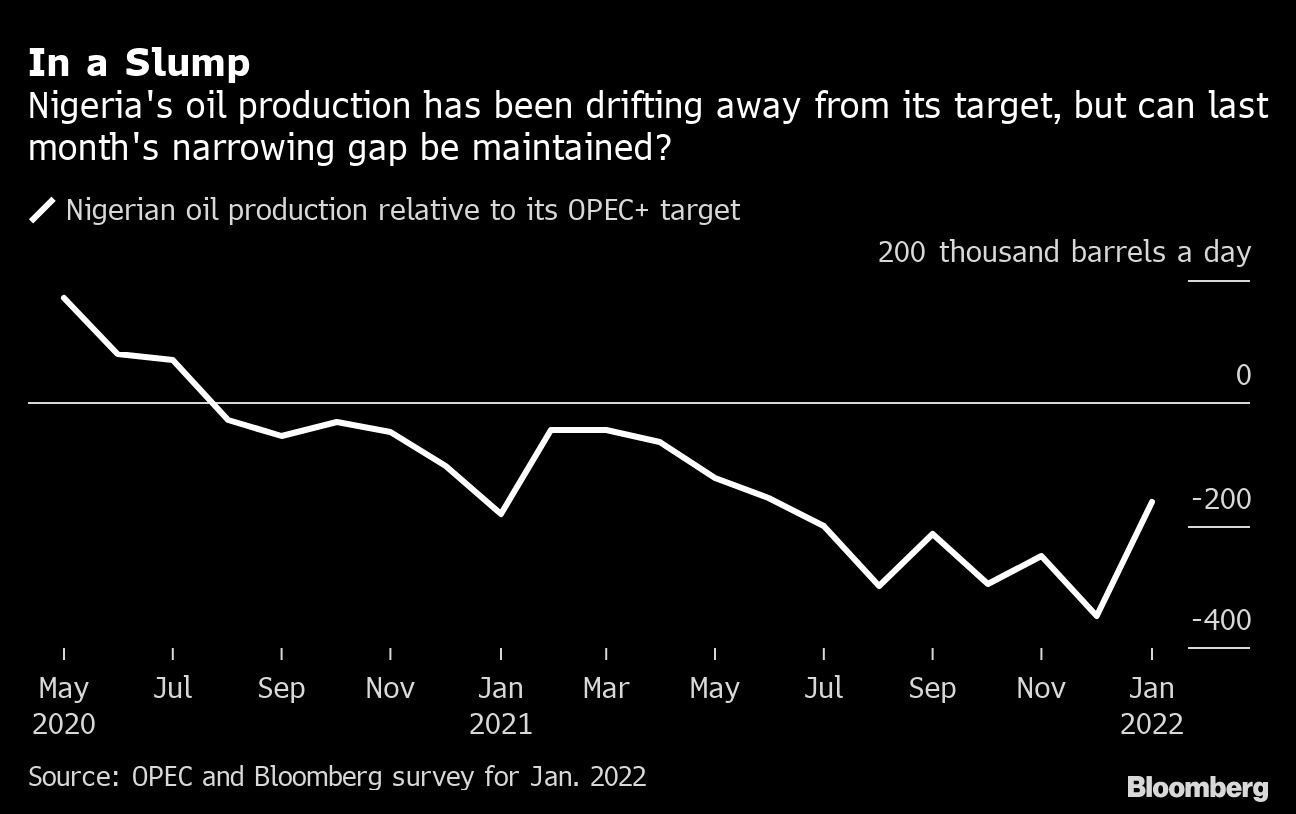

The 23-nation coalition led by Saudi Arabia rubber-stamped a nominal increase of 400,000 barrels a day for March, but data continue to show most members failing to provide their share of even this modest increment. Lack of investment or militia unrest are taking a toll on exporters from Nigeria to Libya, placing an increasing strain on the remaining reserves of Middle Eastern countries.

The group’s shortcomings have helped propel crude prices to a seven-year high above US$90 a barrel, as supplies fail to keep pace with the vigorous post-pandemic rebound in fuel consumption. The rally is whipping up a wave of inflation that’s frustrating central banks and inflicting a cost-of-living crisis on millions -- a particular danger for President Joe Biden ahead of this year’s midterm elections.

With spare capacity now largely confined to Saudi Arabia, the United Arab Emirates, Iraq and Kuwait, traders are growing anxious over what’s available to cover any disruptions -- whether deeper losses in Libya, another attack like last month’s drone strike in Abu Dhabi, or tensions between Russia and the West over Ukraine.

“Core to our bullish oil price view is the now historically low levels of the oil market’s two buffers: inventory and spare capacity,” analysts at Goldman Sachs Group Inc. led by Damien Courvalin said in a report. “Even if OPEC+ were ramping up faster, this would only come at the expense of a critically lower level of spare capacity.”

The Organization of Petroleum Exporting Countries and its partners ratified their scheduled increase at a short online meeting on Wednesday. The group has made identical promises for several months, however, and been unable to fully implement them.

As doubts grow about the whether the anticipated expansion in global inventories will actually happen this quarter, forecasts are piling up for a return to prices of US$100 a barrel or more. Such a rally could ultimately provoke enough pressure from Saudi Arabia’s allies in Washington for a change of stance.

“If prices continue their precipitous rise, we see a path to Saudi Arabia reprising the regulator role and ramping up output,” said Helima Croft, chief commodities strategist at RBC Capital Markets. “Of course, the question is whether this would require a White House call.”

Riyadh’s reluctance so far stems from a concern that markets are about to tip back into surplus, as producers in the U.S. and elsewhere begin ramping up production. Saudi Energy Minister Prince Abdulaziz bin Salman has repeatedly favored cautious, gradual supply changes.

“Prudence as I’ve been preaching about is what saved us in OPEC+,” he said just a few hours ahead of the meeting today at a conference in Riyadh. “Prudence dictates that you have a bit of a think here and a bit of think there.”

Any extra barrels though would need to come from the kingdom and its Gulf neighbors as other members are largely maxed out.

OPEC’s 13 nations increased production by only 50,000 barrels a day in January as slight gains across the group were wiped out by a 140,000 barrel-a-day decline in Libya, according to a Bloomberg survey. The North African nation was stricken with a blockade of its western fields by militias, forcing the shutdown of its biggest reservoir, Sharara.

The 10 OPEC nations engaged in managing supplies increased by 160,000 barrels a day in January, about two-thirds of their targeted amount. The full 23-nation OPEC+ alliance is cutting far more than required, with a compliance rate of 122 per cent in December, according to data presented to an internal committee on Tuesday.

Even Russia, which throughout the five-year history of OPEC+ has often preferred to increase production more quickly, is suffering from constraints. The country’s producers pumped 46.53 million tons of crude and condensate in January, according to preliminary data from the Energy Ministry’s CDU-TEK unit. That could convert to 10.05 million barrels a day, or 50,000 below its quota for the month.

OPEC+ will meet again on March 2.