Jul 13, 2023

Osborne Blamed for Worsening UK Debt by Spending QE Windfall

, Bloomberg News

(Bloomberg) -- Britain’s public finances would be in far better shape had former Chancellor of the Exchequer George Osborne stuck to his promise to use a windfall from quantitative easing to pay down debt, a senior official at the government’s fiscal watchdog said.

Andy King, a member of the Office for Budget Responsibility, said Bank of England’s quantitative easing program has become a problem for the Treasury because the billions of pounds it generated when interest rates were low now have been “spent.”

In 2012, when Osborne changed the rules on QE to sweep billions from the BOE to the Treasury, the government pledged that “income transferred should be used solely to pay down government debt.”

King, who worked for Osborne at the Treasury at the time, said the former Chancellor, now a multi-millionaire banker at City advisory firm Robey Warshaw, never stuck to his pledge.

“When that decision was taken the Chancellor said we will make sure we don’t use this for anything other than reducing debt because we know it’s going to turn around in the future,” King said.

“That’s the thing that did not happen,” King said. “Fiscal targets got changed, that was forgotten, and the money was spent. Now the cash flows are reversed, and there is no pot to pay them. So it’s just contributing to how tight the public finances are right now.”

The government is now grappling with the highest level of borrowing since the mid-1940s, the largest stock of debt since the early 1960s, and highest debt servicing costs since the late 1980s, the OBR said.

QE generated £124 billion ($162 billion) in income between the start of QE in March 2009 and July 2022 due to a quirk in the way it interacts with low interest rates. King said those funds should were supposed to have been ring-fenced so today’s debt burden would be lighter.

Now that rates are higher, QE is expected to cost to the state £242 billion as it’s wound down, £15 billion of which has already been realized. The result would be a net loss of £118 billion for the Treasury over the lifetime of QE.

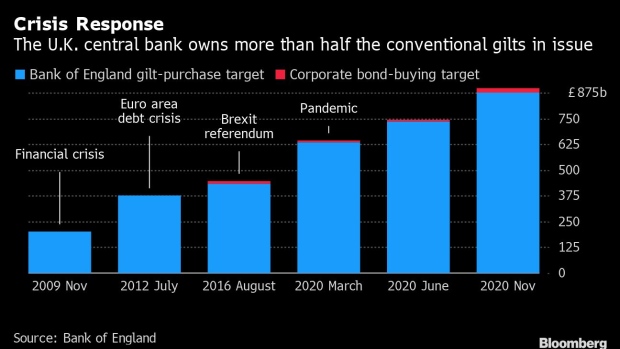

QE began as a £75 billion program but grew to a peak of £895 billion during the pandemic. It was profitable until 2022 because the BOE bought gilts, which generate around 2% interest on average. To buy the gilts, the BOE created reserves on which it pays its benchmark interest rate. Once it raised rates above 2%, the program became unprofitable.

--With assistance from Andrew Atkinson.

©2023 Bloomberg L.P.