Apr 2, 2024

Owner of Crypto Platform CoinSwitch Launches Stock Trading App

, Bloomberg News

(Bloomberg) -- The owner of Indian cryptocurrency exchange CoinSwitch is launching a stock trading app as digital-asset volumes languish following a punitive tax regime introduced two years ago.

PeepalCo on Tuesday announced the launch of Lemonn, which will initially offer equities trading and over time be expanded into product areas like mutual funds and derivatives.

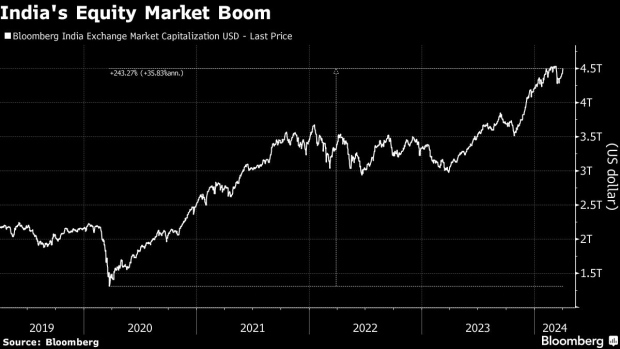

The initiative comes amid an equities boom in India that’s seen the local stock market more than triple in value since the start of the Covid-19 pandemic. Crypto trading, meanwhile, has yet to recover from a transaction tax that took effect in mid-2022, just as digital-asset markets reeled from a series of shocks.

Read more: Retail Traders Lose Billions in India’s Booming Options Market

PeepalCo enters a crowded Indian equities market dominated by apps like Zerodha and Groww. Still, even after the past four years’ relentless advance in stocks, the market remains under-penetrated, according to Chief Executive Officer Ashish Singhal.

“Millions of Indians find stock markets complicated even today, Singhal said in the press release. “Despite the post-pandemic growth, only about 6% of Indians invest in stock markets.”

CoinSwitch, founded in 2017 and backed by Andreessen Horowitz and Tiger Global, restructured its operations in December, creating PeepalCo as the holding company overseeing the crypto platform as well as other new initiatives like a wealth management app. CoinSwitch and Lemonn will be run as separate businesses, Singhal said.

Read more: Binance Loses India Traders to Local Firms It Recently Dominated

©2024 Bloomberg L.P.