Aug 4, 2023

Paying in Cash May Become Constitutional Right for Austrians

, Bloomberg News

(Bloomberg) -- Austria’s government plans to anchor the right to use cash in its constitution, addressing a hot topic for opposition parties agitating about digital currencies.

The government in Vienna has set up a task force to establish how it can enshrine payments with physical money as a constitutional right. That would ensure cash continues to be accepted in shops, and to guarantee access to ATMs to all residents.

“Everyone should have the right to choose how and in what form they want to pay,” Chancellor Karl Nehammer, who faces national elections in 2024, said in a statement. “People in Austria have a right to cash.”

Austrians take cash very seriously. About 54% of them still use it to pay for groceries, compared with 37% who use bank cards, according to a survey published by the OGM research institute in June.

The far-right Freedom Party has campaigned widely against restrictions on cash, part of its push against the European Central Bank’s move toward setting up a digital euro. The opposition Socialist Party recently suggested banks face requirements on installing cash machines — and pay the costs — after a mayor complained about the spiraling bill to retain the only ATM in his village.

Many Austrian restaurants and cafes — mostly outside the capital — still don’t take digital payments, despite tourism being a major part of the economy. At the same time, the pandemic has prompted some shops in Vienna to go cash-free.

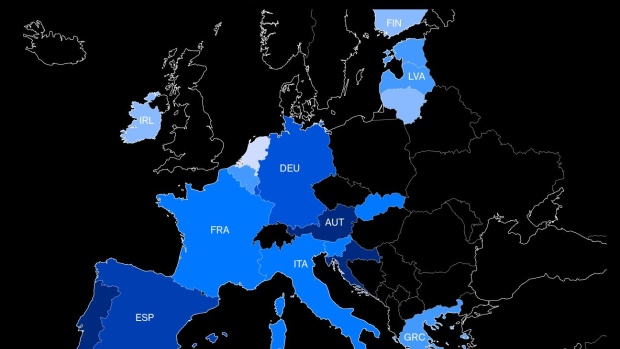

With one of the highest densities of ATMs in the euro area, Austrians need to travel on average only 1.1 kilometer (0.7 miles) to access one of more than 9,000 machines, according to the country’s national bank.

Austria has almost doubled the number of ATMs per million residents since 2000, and has about 80% more cash machines than the EU average, according to ECB data.

Neighboring Switzerland is set to hold a plebiscite on a similar proposal to anchor rights in the constitution. In contrast, cash accounted for only 8% of transactions in Sweden last year amid a proliferation of alternative payment systems.

©2023 Bloomberg L.P.