Jan 28, 2019

Personal Investor: Boost your RRSP contribution with your refund

By Dale Jackson

If you’re scrambling to put together a registered retirement savings plan (RRSP) contribution before the March 1 deadline, there’s a way to boost it by nearly 40 per cent by contributing the refund.

RRSPs are a great way for your savings to grow tax free until they are withdrawn in retirement. You can also lower the previous year’s tax bill by deducting the contribution amount from your taxable income and getting a hefty refund in the spring.

But there is a way to boost your RRSP savings beyond the tax refund amount by contributing the refund before the deadline. Several RRSP refund calculators are available online to help determine how much you would need to borrow to match the extra contribution with the refund amount.

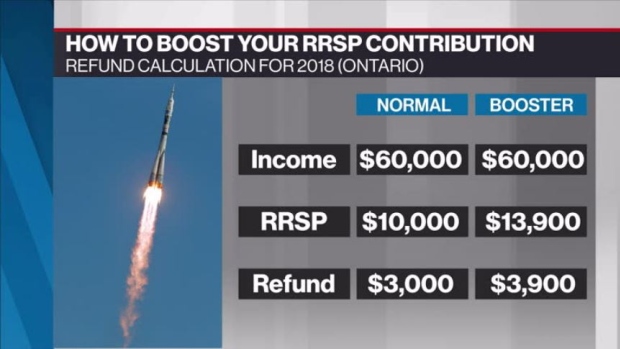

Here’s an example: Assume you have $10,000 saved for you RRSP contribution and your taxable income in 2018 was $60,000. The refund amount varies a bit across Canada, but in Ontario, that $10,000 contribution would result in a $3,000 refund.

By adding that $3,000 to your contribution before the deadline you could actually generate a further tax savings, which would generate further tax savings, and so on. In this example, if you borrowed $3,900 and added it to your original $10,000 contribution (13,900), the refund would come to about $3,900 – which would cover the borrowed amount. That’s almost 40 per cent on the original $10,000.

Many homeowners have the ability to borrow at a low interest rate from their home equity lines of credit, but just about any interest amounts should be small provided the principal is paid back within a few months.