Feb 16, 2018

Personal Investor: Dipping into your RRSP early could yield regret

By Dale Jackson

It seems many Canadians don’t quite get that one of the ‘R’s in RRSP stands for ‘retirement’.

A new study from BMO finds 40 per cent of those polled made early withdrawals from their registered retirement savings plans in 2017. The average withdrawal was $21,000; a rise of $3,740 over the previous year.

The study also looks into why Canadians dipped into their RRSPs early. Of those polled, 27 per cent said it was to purchase a home. That could be a prudent way for first time home-buyers to borrow up to $25,000 for a down payment without tax consequences, but could backfire if the money is not returned to the plan within 15 years. Ottawa has a similar exemption under the Lifelong Learning Plan where you can borrow up to $20,000 from your RRSP to go back to school.

The study also found that 23 per cent dipped into their RRSPs early to help pay living expenses, 21 per cent needed the cash for emergencies and 20 per cent used it to pay down debt.

Whether or not it’s a good idea to dip into your RRSP early comes down to one basic consideration: Your income tax bracket in the year you make the withdrawal.

When originally contribute funds to an RRSP, your refund is based on your taxation level at the time. If you withdraw funds when your income is higher, and you are in a higher tax bracket, you will be paying more to withdraw.

If your source of income has been reduced, it could make sense to make an RRSP withdrawal because it will eventually be taxed at the lower income level.

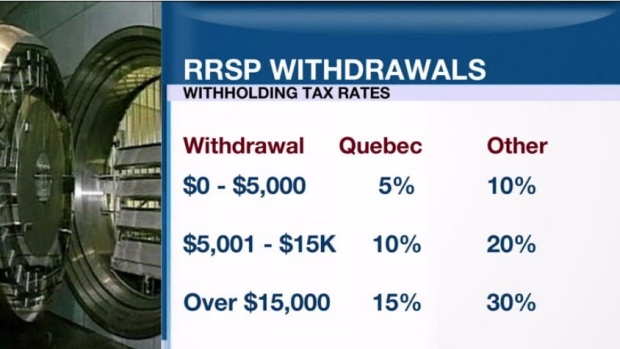

The operative word is “eventually.” Any RRSP withdrawal before the plan holder turns 65 is subject to a withholding tax as high as 30 per cent. That means 30 per cent is skimmed off the withdrawal at the source. If you’re in a tax bracket higher than 30 per cent, you will owe more. If you’re in a lower tax bracket, you will get a refund when you file your income tax. The whole point of RRSPs is to allow them to grow tax-free over several years and withdraw the funds in retirement when most people are in a lower tax bracket.

Denying yourself time for money to grow could make the other ‘R’ in RRSP stand for ‘regret’.