Jan 31, 2018

Personal Investor: Your Money Month is about life after the RRSP deadline

By Dale Jackson

February is like Christmas for the investment industry. Advisors and brokers jockey for the millions of dollars regular Canadians contribute to their registered retirement savings plans before the contribution deadline on Mar. 1.

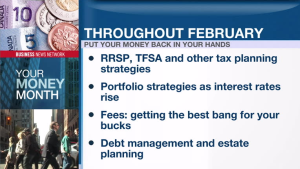

But before you make that RRSP contribution, there are probably things you should know. Perhaps an RRSP contribution is not the right move for your situation. Maybe a tax-free savings account (TFSA) contribution, or even paying down debt, is a better way to employ your money.

If you decide to contribute to your registered accounts, how should you invest it in a rising interest rate environment – stocks, bonds, mutual funds, or exchange traded funds?

What are the best research tools for the do-it-yourself investor? How does your investment advisor measure up and how do you find the best advice for the lowest fees?

Throughout February, BNN will attempt to answer those questions and many more relating to personal finance, including debt management and estate planning.

More important, Your Money Month is all about you. CTV’s Chief Financial Commentator Pattie Lovett Reid will be answering your questions in a series of blogs aimed at getting you on the right financial track.