Jun 8, 2023

Peru Holds Interest Rates at 22-Year High as Inflation Cools

, Bloomberg News

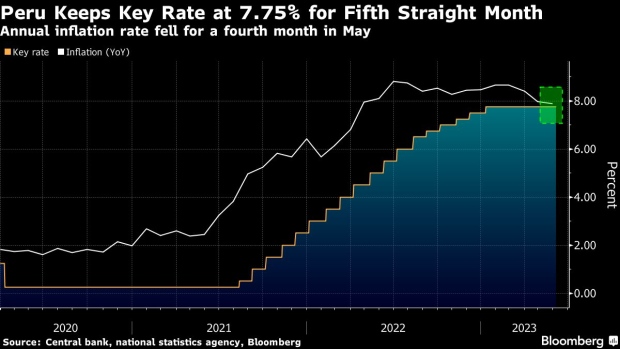

(Bloomberg) -- Peru held interest rates at a 22-year high to ensure that inflation slows decisively toward its target.

The central bank left its benchmark interest rate at 7.75% on Thursday, as forecast by all 11 economists surveyed by Bloomberg.

Central banks in Brazil, Chile and Mexico have also halted monetary tightening cycles, while Colombia may end its steepest-ever hiking cycle this month. In Peru, stubborn core inflation and high inflation expectations limit room for interest rate cuts, even though economic growth is forecast to slow this year.

The bank said that inflation will be “close” to its target range by the end of the year, whereas last month they said it would have fallen to 3% by that date.

Consumer prices rose 7.9% in May from a year earlier, above the target range of 2%, plus or minus one percentage point.

Read More: Peru Economy Seen Growing 0.6%-0.7% in April Y/Y

The bank unexpectedly paused its steepest-ever series of interest rate hikes in February, over concern that massive anti-government protests would hammer the economy. Those protests are now over and initially led to a surge in inflation, especially food prices, that’s begun to abate.

Peru’s Finance Ministry has said the biggest risk to the economy this year remains a crippling El Nino weather pattern, which would bring renewed rains and flooding to Peru’s northern region. The area is an agricultural hub and disruptions could lead to higher food prices.

--With assistance from Rafael Gayol.

(Adds central bank inflation forecast in 4th paragraph.)

©2023 Bloomberg L.P.