Jul 1, 2022

Poland’s Inflation Surge Comes With Mounting Signs of Slowdown

, Bloomberg News

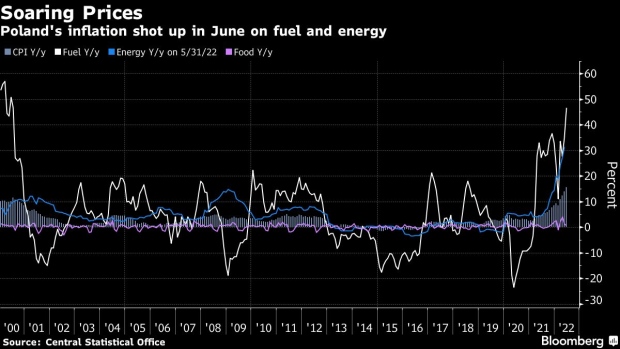

(Bloomberg) -- Polish inflation hit a fresh quarter-century high, while evidence of rapidly slowing manufacturing in the country creates a dilemma for policy makers as they weigh a 10th straight interest-rate increase.

Consumer prices rose 15.6% in June from a year earlier, roughly in line with estimates from a Bloomberg survey of economists, and up from an annual pace of 13.9% in May, the statistics office said on Friday. Separately, a gauge of manufacturing showed a sharp contraction in output as the turbulence sparked by Russia’s invasion of Ukraine took its toll.

Central bank Governor Adam Glapinski said last month that Poland is gradually approaching the end of a “drastic” cycle of tightening as inflation is expected to peak and concerns over an economic slowdown emerge. Policy makers will meet on Thursday and any rate increase of more than half a percentage point would “carry a big risk,” according to Piotr Bujak, chief economist at PKO Bank Polski SA.

The drop in June purchasing managers index for manufacturing -- to 44.4 from 48.5 in May -- confirms that the run of growth in the industry since mid-2020 is “well and truly over,” according to Paul Smith, Economics Director at S&P Global Market Intelligence.

Price indexes “are finally showing clear signs that inflationary pressures are easing,” Smith said. “However, these are most likely being driven by demand contractions and it remains to be seen how far the downturn will have to be to finally bring us back to a semblance of demand-supply equilibrium.”

©2022 Bloomberg L.P.