Dec 20, 2022

Pound Risks Lagging the Euro in 2023 as Central Banks Diverge

, Bloomberg News

(Bloomberg) -- The pound has slid against the euro this year and it risks flopping again in 2023.

The UK currency is under pressure from the Bank of England turning more cautious on further interest-rate hikes, just as the European Central Bank amps up its rhetoric on the need for more action to tame inflation. Analysts including from Royal Bank of Canada and Bank of New York Mellon see the euro rising against sterling.

It’s a trade based on what’s shaping up to a key theme for the new year: the divergence of monetary policy. Traders are looking at which policy makers will blink first, following aggressive rate hikes by central banks in tandem across the world this year.

“It’s a consistent theme, a mispricing of rate expectations — and the most extreme example of that would be euro-sterling,” said Adam Cole, head of currency strategy at RBC. He expects the currency pair to rise more than 3% by the end of 2023 to reach 0.90 — a level last seen during the UK’s “mini-budget” market chaos in late September.

While the consensus in a Bloomberg survey is only for a rise to 0.89, from current levels around 0.87, Commerzbank AG and TD Securities see 0.90 being reached by June. Sentiment is turning against the pound after the final central bank meetings of the year last week.

While both the BOE and ECB raised interest rates by 50 basis points, the former saw two voting members call for no change, while the latter’s decision was followed by a chorus of policy makers saying that rates would have to rise beyond what markets are expecting. That drove the euro up 1.4% last week to hit a one-month high against the pound.

“Euro-sterling is probably the best way to play this,” said Geoff Yu, senior currency strategist at Bank of New York Mellon, adding the BOE won’t hike rates as much as markets are pricing.

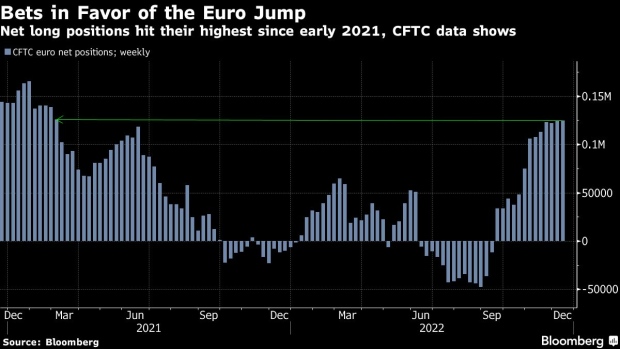

Given that the Federal Reserve is also sticking to its guns on the need for more rate rises to finish the job on driving down inflation, the euro may have limited room to gain against the dollar, where positioning is already in favor of the common currency, strategists said.

Continued Fed and ECB hikes also increase the chances of a harder landing for the global economy, which would be negative for riskier assets like the pound, said Lee Hardman, currency strategist at MUFG.

“I could be more that the euro outperforms more clearly against other higher-beta currencies, including sterling,” Hardman said.

©2022 Bloomberg L.P.