Mar 12, 2020

Pound Suffers in Market Mayhem With BOE Seen Easing More

, Bloomberg News

(Bloomberg) --

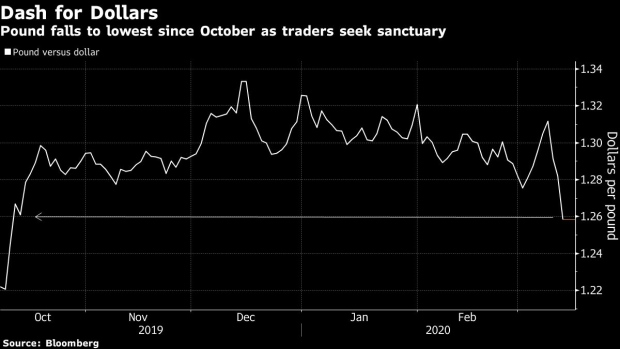

The pound stumbled to its weakest level since October as investors sought sanctuary in U.S. dollars from the coronavirus pandemic.

The decline saw sterling achieve its worst three-day run since the 2016 Brexit referendum, losing more than 4% by 3:40 p.m.

“It’s a dash for dollars,” said Ned Rumpeltin, head of European foreign-exchange strategy at Toronto-Dominion, by email. “The dollar funding markets have tightened considerably and the ECB’s lack of urgency displayed today has not helped matters. Sterling is being dragged along for the ride.”

Weakness in the pound was particularly notable as just a day earlier the U.K. has undertaken coordinated fiscal and monetary measures to cushion its economy for the fallout of the coronavirus. Speculation is rising that the Bank of England could ease policy even further after this week’s emergency stimulus measures.

Despite the BOE slashing rates by 50 basis points, a move unseen since the 2008 financial crisis, money markets are still pricing in a 44% chance of a further 15 basis point cut in its March 26 gathering -- that would take the bank rate to an historic low of 0.10%.

“It’s a combination of general agreement that the dollar is the risk aversion haven of choice, and suffering from the policy easing yesterday from the BOE,” said Neil Jones, head of foreign-exchange sales to financial institutions at Mizuho Bank Ltd.

The pound fell 2%, the most since November 2018, to $1.2562. The yield on 10-year bonds declined two basis points to 0.28%.

To contact the reporters on this story: William Shaw in London at wshaw20@bloomberg.net;Anooja Debnath in London at adebnath@bloomberg.net

To contact the editors responsible for this story: Dana El Baltaji at delbaltaji@bloomberg.net, Pete Norman

©2020 Bloomberg L.P.