Mar 7, 2023

Powell’s Shift on Rate Hikes Comes as Officials Prepare for March Meeting

, Bloomberg News

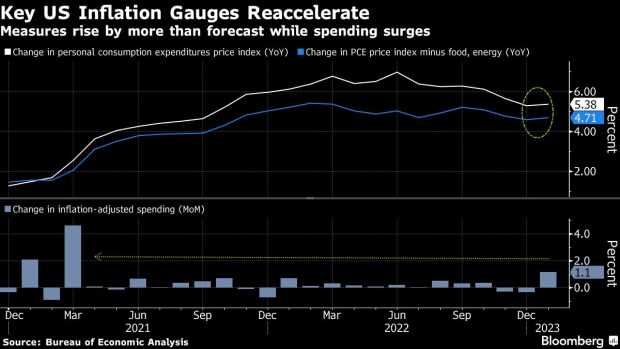

(Bloomberg) -- Less than five weeks after the Federal Reserve slowed its pace of interest-rate hikes, Chair Jerome Powell on Tuesday served warning it may need to re-accelerate.

Powell, who on Feb. 1 declared he could now say the “disinflationary process” had begun, delivered a notably different message at a congressional hearing Tuesday morning.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell told the Senate Banking Committee. “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

Investors reacted, sending two-year Treasury yields above 5% for the first time since 2007. For the March 21-22 Fed meeting, futures trading suggests a 50 basis-point rate increase is more likely than 25 — the magnitude of the Fed’s last move. Stocks slid.

While Powell has long stressed the Fed must be nimble in setting policy at a time of high uncertainty regarding the stubbornness of inflation, the unexpectedly clear opening of the door to 50 basis points later this month took even some veteran market participants by surprise.

Goldman Sachs Group Inc. raised its forecast for the Fed’s peak rate by a quarter point, to a range of 5.5% to 5.75%.

Powell’s shift could feed questions about whether the Fed was premature in slowing to a quarter-point clip last month. That would be a third strike against a Fed that a year ago underestimated how persistent price increases would be and initially hiked slowly. But officials say this recovery is unusual and policy must follow the data.

Key Data

The Fed chair noted the upcoming policy decision will be shaped by key economic releases for February. The monthly employment report is due Friday, followed by data on inflation March 14 and retail sales the following day.

His remarks, and an exchange with Democratic Senator Elizabeth Warren over the risks to the labor market, revealed a side of Powell that has been there all along: He views the institutional and national economic costs to losing the 2% inflation anchor as nothing short of catastrophic.

In Powell’s view, the risks of doing too little outweigh the risks of doing too much because higher inflation would creep into all facets of economic decisions — perpetuating faster price increases.

Powell’s own legacy is also at stake, and, depending how he lands the economy back to lower inflation, so is the 2024 presidential election.

“Powell has shifted the focus back to the size of the prospective rate hikes since the January employment and consumer spending data were stunningly stronger than anticipated and inflation stickier than expected,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance Co. Such moves would increase “the risk the Fed overdoes the tightening.”

A return to half-point hikes would reverse the step down the Fed engineered over the past three meetings, from 75 basis points to 50 and then 25 last month. Officials explained at length over the past year their strategy was to move rapidly into what they deemed restrictive territory, and then shift to a slower pace to gauge how the economy was reacting.

Correcting ‘Mistake’

“They’re trying to correct the mistake of not sticking with 50 in February,” said Derek Tang, an economist at LH Meyer/Monetary Policy Analytics in Washington. “But putting the focus back on pace is a mistake,” he said, adding that it “smacks of alarm.”

Typically, Powell leads from the center of the policy-setting committee, yet Tuesday’s remarks showed him willing to walk away from the consensus that prevailed after the February meeting.

If the data remain strong, that would put any advocates of a quarter-point hike in the position of arguing against the chair. Some analysts noted Powell’s shift was unveiled after Lael Brainard — viewed as a proponent of slower rate increases — had stepped down as Fed vice chair.

“When Lael’s Away the Hawks Will Play,” JPMorgan Chase & Co. chief US economist Michael Feroli said in the title of his research note on Powell’s testimony Tuesday. Feroli said on Bloomberg TV he hadn’t yet changed his call for a quarter-point March, but viewed it as tough for Powell to walk back his Tuesday message without the upcoming data being “not just in-line, but weaker than expected.”

Political Tensions

Meantime, rising political tensions were apparent in a testy exchange with Warren, as the progressive from Massachusetts criticized Powell for putting the labor market at risk.

Using the Fed’s own estimates, Warren said Fed rate increases risk throwing about 2 million people out of work.

“How would you explain your view that they need to lose their jobs?” Warren asked.

Powell responded: “Will working people be better off if we just walk away from our jobs and inflation remains 5% to 6%?”

He also noted during the hearing that the labor market has yet to buckle under higher borrowing costs. The unemployment rate dipped to 3.4% in January, the lowest in more than five decades, while Black unemployment fell to 5.4%, near a record low.

It’s “hard to make a case that we have over-tightened,” Powell said in response to a question. “You are a long way from anything that looks like a recession just looking at the labor market,” he said to another senator, adding that the Fed may achieve 2% inflation without a sharp downturn.

--With assistance from Steve Matthews, Catarina Saraiva and Jonnelle Marte.

©2023 Bloomberg L.P.