Dec 8, 2022

Pricey US Stocks Pose a Risk to 2023 Recovery, Say Citi Strategists

, Bloomberg News

(Bloomberg) -- The rally in US stocks has brought valuations to levels where they no longer price in a contraction in earnings, posing a risk to the recovery, according to Citigroup Inc. strategists.

Current prices are “too optimistic,” strategists led by Robert Buckland wrote in a note. The MSCI USA index is now implying a 4% earnings-per-share growth next year, close to the analyst consensus but far from Citi’s expectation of a 3% contraction, the team noted.

The S&P 500 advanced as much as 17% from its October lows through the end of November on expectations the Federal Reserve would take a less aggressive approach to tightening policy, before stronger-than-expected economic data dimmed these hopes. Even after pulling back over the past five days, the gauge is now trading at 17.1 times forward earnings, up from this year’s low of 15.2 times and in line with the average for the past decade.

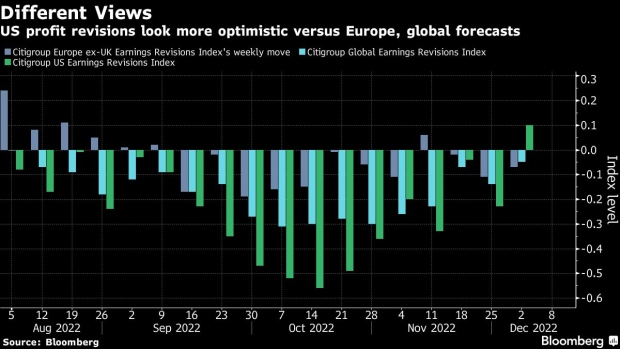

Earnings upgrades outpaced downgrades in the US for the first time since May last week, even though downgrades prevailed globally, according to a Citi index. Buckland said analysts are too optimistic. His team forecasts a 5% to 10% drop in the MSCI ACWI Index’s earnings-per-share next year while analysts predict 3% growth.

Among developed markets, “the UK looks most cautious” with a 20% earnings recession priced in, Buckland wrote. European and emerging-market equities still discount a drop of around 10%, he said.

For sectors, cyclical stocks like financials and energy are already discounting a 20% earnings recession. Meanwhile, growth sectors are priced higher — especially in the US. “This leaves little room for error,” Buckland said.

©2022 Bloomberg L.P.