Jun 14, 2018

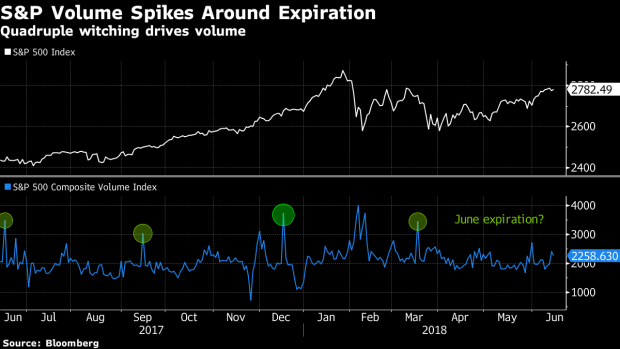

'Quadruple Witching' Likely to Drive S&P Volumes Into Expiration

, Bloomberg News

(Bloomberg) -- Thursday’s S&P volume dropped by 7 percent from Wednesday but investors should not expect that trend to continue, at least in the near-term.

June expiration for options and futures on stocks and indexes is set for Friday, marking the second "quadruple witching" event for 2018. That’s sure to bring a spike in volume as traders rebalance positions.

"Since the end of last week, dealers are short gamma via short ETF and single name technology calls which has spurred buying around any sell-off and especially on spikes higher as the calls get deeper in the money," Oppenheimer Head of Institutional Equity Derivatives Alon Rosin said in an email to Bloomberg. "We would consider fading rallies around artificial strength into expiration around the open but using tight stops on short trades post opening prints," Rosin said.

To contact the reporter on this story: Gregory Calderone in New York at gcalderone7@bloomberg.net

To contact the editors responsible for this story: Arie Shapira at ashapira3@bloomberg.net, Jeremy Herron

©2018 Bloomberg L.P.