Sep 20, 2022

RBA Will Post ‘Substantial’ Loss, Negative Equity, Bullock Says

, Bloomberg News

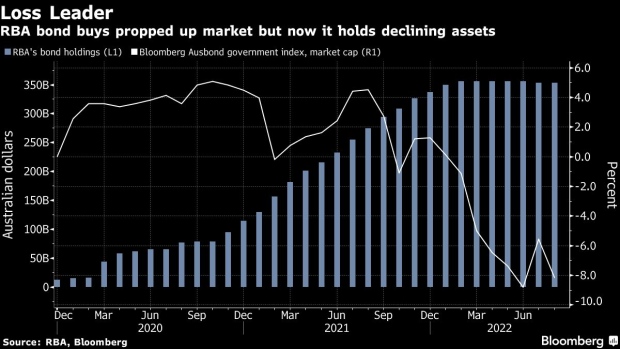

(Bloomberg) -- Australia’s central bank recorded a “substantial” loss last fiscal year and is temporarily in negative equity, Deputy Governor Michele Bullock said, as she suggested rapid interest-rate increases haven’t yet taken policy into restrictive territory.

In the 12 months through June, the Reserve Bank posted an accounting loss of A$36.7 billion ($24.5 billion) and a A$12.4 billion negative equity position, Bullock said in a speech at Bloomberg’s Sydney office on Wednesday. The RBA’s status is unusual as central banks typically use a government indemnity.

“The board has indicated to the government that it expects that future profits will be retained by the bank until the bank’s capital is restored,” Bullock said. “The treasurer has endorsed this general approach.”

Bullock spoke hours after the RBA released an internal review of its 15-month quantitative easing program that found benefits to the economy and the government’s fiscal position from the bond purchases. But it also showed costs to the bank will mount as it keeps increasing interest rates.

The RBA has raised its cash rate to 2.35% from 0.1% in May, in its fastest tightening cycle in a generation. Asked whether policy has reached a level where it’s slowing the economy, Bullock said “I’m not sure it’s necessarily in restrictive territory yet.”

She said the board is focused on balancing inflation and growth, adding on the cash rate, “we’ll be looking to see whether or not there are opportunities to taper a bit and slow the pace. But we are not on a pre-set path.”

Australia’s efforts to safeguard growth contrast with the Federal Reserve and other central banks that are determined to crush inflation at almost any cost. Bullock said one of the differences is that wages in Australia haven’t taken off like in the US and UK, pointing out “there’s much more an underlying momentum in inflation psychology in those countries.”

Asked about a new monthly Australian inflation gauge the local statistics bureau plans to release, including CPI data for July and August next Thursday, Bullock said it’s unlikely to have a major impact on the October policy meeting.

“There’s a little bit of water under the bridge to go with monthly CPI numbers,” she said, adding the bank would have to see what sort of information was contained in them.

“Our forecast for inflation are to peak at 7-3/4 to 8% early into next year,” she said. “Those are the numbers that we are currently working with.” The bank will release a quarterly update of its forecasts in early November.

Bullock, echoing minutes of the September meeting released Tuesday, expressed concern about the prospects for the traditional drivers of world growth: China, the US and Europe.

“The outlook for the global economy is looking quite uncertain and quite worrying and that obviously has implications for us,” she said. “This is something at the moment that is very uncertain and on a bit of a knife edge.”

Bullock said today the RBA has no plans to sell the bond holdings built up under QE, reinforcing the cash rate is the primary tool.

In the bank’s review of its bond buying program, it said the board had agreed to strengthen the way it considers a wide range of scenarios when making monetary policy decisions in future. That’s especially the case where they involve unconventional measures like QE.

Bullock said it would only be appropriate to use unconventional policies in future in “extreme circumstances.”

As to the bank’s losses, she explained the RBA is now in a position where the interest it earns on its assets is less than what it receives.

Bullock pointed out that if any commercial firm had negative equity, its assets wouldn’t be sufficient to meet liabilities and therefore it wouldn’t be a going concern.

“But central banks are not like commercial entities,” she said. “Unlike a normal business, there are no going concern issues with a central bank in a country like Australia.”

©2022 Bloomberg L.P.