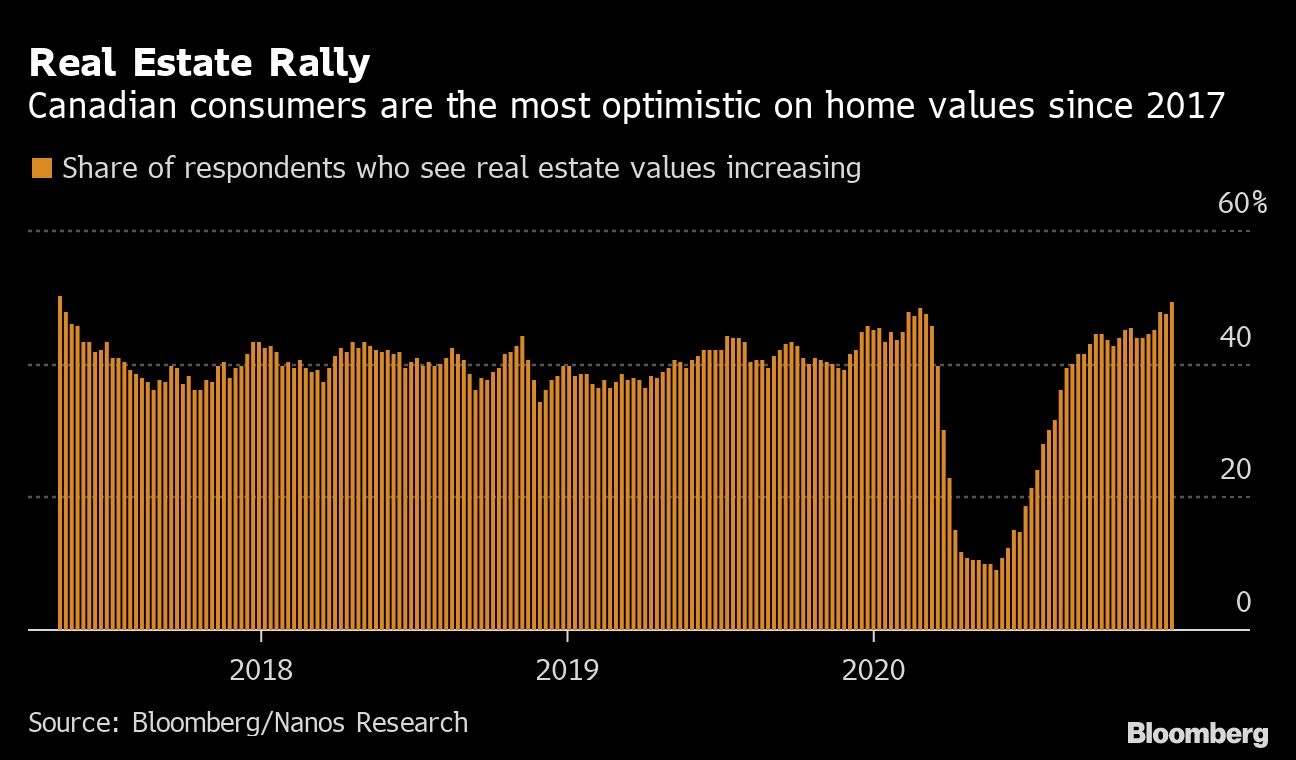

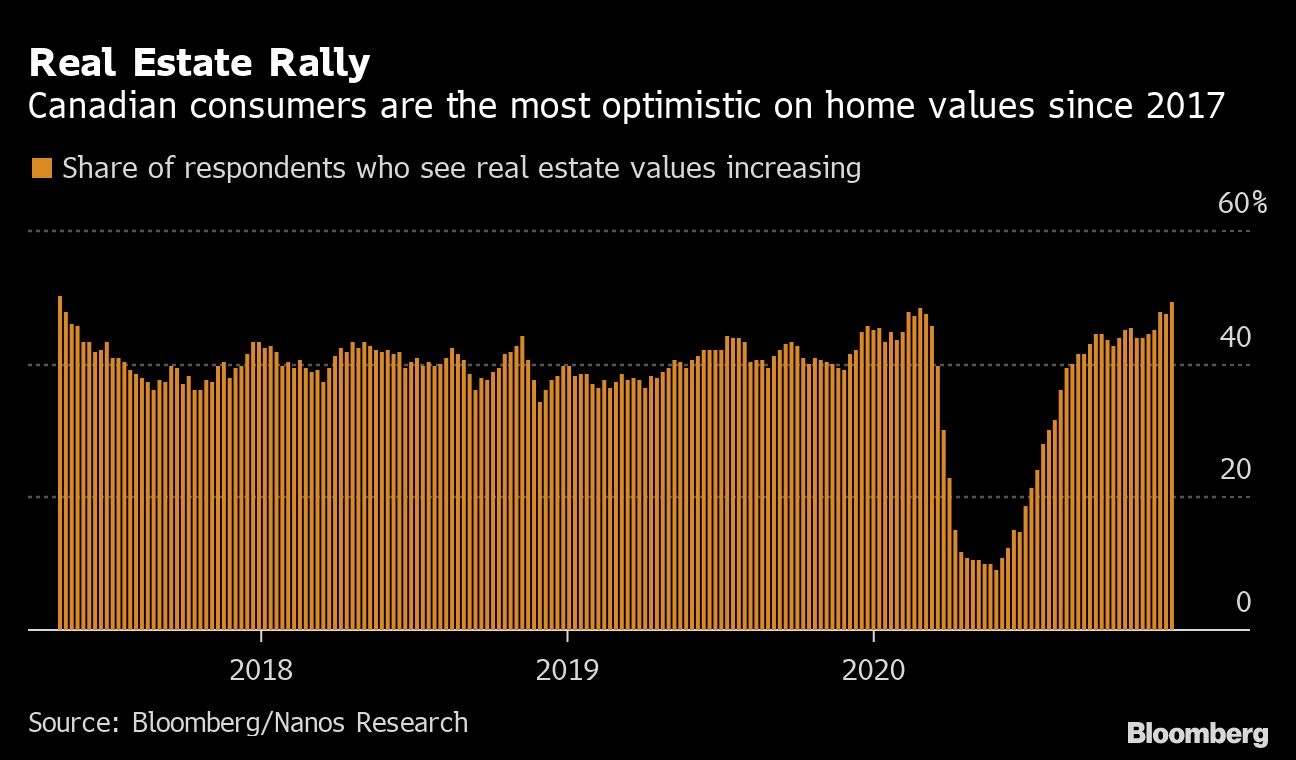

Canadians are the most confident in more than three years that real estate prices will continue to rise, according to weekly telephone polling, a positive signal for the recovery.

About half of respondents, or 49.2 per cent, see home prices climbing over the next six months, the highest share since May 2017. That helped lift the Bloomberg Nanos Canadian Confidence Index, a composite measure of financial health and economic expectations, to 55.1 last week, levels last seen in early March.

It’s been nine months since Canada first shut down its economy to contain the spread of COVID-19, leading to a record plunge in consumer confidence. The index began to recover over the summer but a second wave of virus cases put the brakes on that.

However, the vaccine rollout that began this month in Canada is stirring hopes that the pandemic’s end is near even as case counts continue to rise. Two of the largest provinces, Ontario and Quebec, have tightened restrictions to try to control the spread.

Record-low interest rates and strong demand for more spacious accommodation are pushing Canadian home prices and sales to record highs this year. Prime Minister Justin Trudeau’s government has pledged to keep the fiscal taps open to support the recovery, and the income support measures have left households flush with cash.

“Consumer confidence in Canada continues to gain strength with news on vaccines,” Nik Nanos, chief data scientist at Nanos Research, said in the report. “Forward perceptions on both the strength of the economy and the value of residential real estate gained a full five percentage points in the past four weeks of tracking.”

Every week, Nanos Research surveys 250 Canadians for their views on personal finances, job security, the economy and real estate prices. Bloomberg publishes four-week rolling averages of the 1,000 responses.

Key Highlights

- Real estate optimism continued to climb, with only 12.7 per cent of respondents saying they believe home prices in their neighborhood will decrease in the next six months, the lowest share since early March

- Views on the economic outlook also improved. Some 23.7 per cent of consumers expect the country’s economy to be stronger in the next six months, the largest share since June and up from 18.1 per cent at the end of November

- Views on personal finances were largely unchanged last week with 14.9 per cent of Canadians saying they were better off compared with a year earlier, and 25.7 per cent saying they were worse off

- Measures of job security fell on the week but were still higher on the month

- Sentiment rose in every province except Quebec, which is experiencing some of the strictest containment measures to lower virus cases