Jul 14, 2022

Recession Fears Crash Strongest-Looking Oil Market in Years

, Bloomberg News

(Bloomberg) -- What happens to oil prices when fear of a recession collides with one of the strongest physical oil markets ever?

They tumble.

Or at least that’s been the case for the past month or so, and again on Thursday with both Brent and West Texas Intermediate tumbling below the levels they were at before Russia invaded Ukraine, bringing historic disruption to oil flows.

The headline price of both grades has now lost about 22% since early June, meeting the technical definition of a bear market. The rout is slowly filtering its way through to lower fuel prices for consumers, offering what could be an early glimpse of relief on runaway inflation.

“It’s just what is the most powerful driver at any point in time, and right now I think that economic deceleration is a very powerful pressure on oil markets,” said Marwan Younes, president of Massar Capital Management, a hedge fund that manages about $1.2 billion in assets. “The deceleration of the global economy in general, and the US economy in particular, is really what’s front and center.”

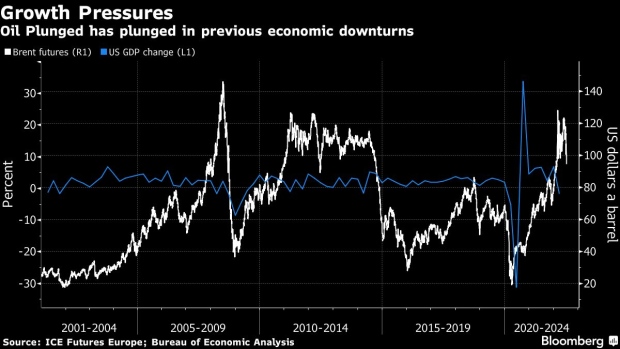

Younes estimates that oil prices slumped by an average of 30% to 40% during the past five US recessions. If that’s correct, it would bring Brent down as low as $75 and WTI toward $70. They’re around $92 and $95 respectively Thursday after taking another big leg lower.

But the underlying physical oil market appears anything but weak.

Russia’s invasion of Ukraine means that there’s a European Union embargo looming on one of the world’s largest producers. Libyan supply has once again ground close to a halt and political infighting continues in the north African country. All of that is before even giving consideration to a continued underinvestment in global oil production.

Bulls say that washout is overdone, as it ignores a tightness of supply here and now. Brent futures for nearby delivery have been trading more than $3 above those for the next month since late June, indicating traders are willing to pay up to secure physical barrels. Prior to Russia’s invasion of Ukraine the global benchmark had never sustained premiums of that kind.

Real-world crude prices “are trading at a historically large premium to Brent futures, reflecting the tightness in physical markets that remain in deficit,” Goldman Sachs Group Inc. analysts including Damien Courvalin wrote in a note to clients this week. “With inventories at record levels and with a potential increase in Saudi/UAE production further depleting record low spare capacity, we reiterate our view that the skew to prices from here is squarely skewed to the upside.”

The strength in crude has been propped up by stellar refining margins. Shell Plc said earlier this month that it may have made as much as $1 billion from its refining business last quarter. BP Plc’s indicative global refining margin was at more than $45 a barrel in the second quarter, up from $19 in the first, meaning refiners can afford to pay huge premiums for physical crude.

But all of that has been lost in a wider repricing of global financial markets.

A gauge of dollar strength is trading at its highest level ever, and everyone from hedge funds to investment banks have been backing the greenback to rally further. That’s bad news for dollar-reliant emerging markets, which now make up a bigger proportion of demand than they did in prior economic slowdowns.

The upshot is that investors have been turning more cautious. Last week speculators pulled almost 100,000 net-bullish Brent and WTI bets, the most since March -- equivalent to 100 million barrels. The biggest long-oil exchange traded fund has seen more than $800 million in outflows since April.

And alongside that, there are already tentative signs that high gasoline prices could be impacting consumption.

Last month, nationwide prices in the US topped $5 a gallon for the first time. The nation’s recent gasoline demand figures were the weakest seasonally in a quarter of a century, while road fuel sales in the UK were down more than 3% on a year earlier last week.

“In this recession the economic damage is going to be fairly dramatic,” Younes said. “We’re going to have a crushing deceleration and its going to affect demand.”

©2022 Bloomberg L.P.