Sep 20, 2022

Riksbank Kicks off Global Hiking Push With 100 Basis-Point Move

, Bloomberg News

(Bloomberg) -- The Riksbank raised its interest rate by a full percentage point in its most aggressive tightening in almost three decades, kicking off a global round of monetary-policy action to bring prices under control.

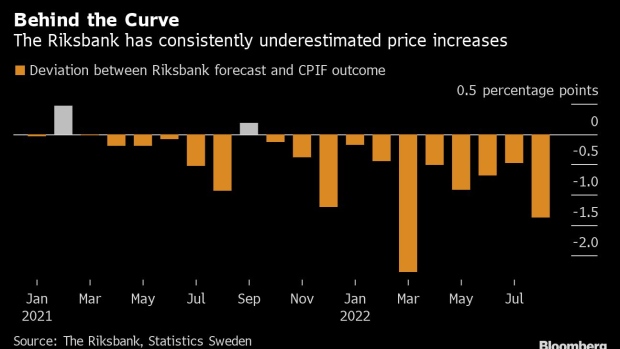

The Swedish central bank lifted its policy rate to 1.75%, defying the predictions of most economists for a smaller move as officials escalated their response to consumer-price increases that have exceeded their forecasts for 11 straight months. It was the biggest increase since the Stockholm-based bank set up its current policy regime, with a 2% inflation target, in the 1990s.

“The risk is still large that inflation becomes entrenched, and it is extremely important that monetary policy acts to ensure that inflation falls back and stabilizes,” officials said in a statement. “Monetary policy now needs to act more than was anticipated in June.”

By this time next year, the rate is likely to have reached 2.5%, which implies another three quarters of a percentage point in tightening, according to their new forecasts.

“While the Riksbank’s rate hike was bigger than expected, the road ahead is if anything less aggressive,” Claes Mahlen, chief strategist for Handelsbanken, said in a report anticipating a half-point increase in November and a quarter point in February.

Against that backdrop, the krona fell versus the dollar after the decision, trading down 0.3% at 10.8072 per dollar as of 11:06 a.m. in Stockholm.

The out-sized move on Tuesday places the Riksbank alongside the Bank of Canada as one of the only two central banks overseeing the world’s 10 most-traded currencies to have hiked by such an amount this year.

What Bloomberg Economics Says...

“The big move signals a strong commitment to tackling inflation. The rate is currently at a multi-decade high and there are concerns it could become entrenched amid upcoming wage negotiations. We expect the Riksbank to hike the policy rate by 75 basis points in November. Uncertainty in energy prices increases the risk of an even larger hike in the winter.”

-- Selva Bahar Baziki, economist

For the full note, click here.

In August, Swedish inflation reached another three-decade high at 9%, highlighting how policy makers had underestimated price increases after what was long one of the most stimulus-friendly approaches in the rich world.

That led Governor Stefan Ingves to forebode more aggressive action earlier this month, by saying that monetary policy is beyond taking small steps. He will leave the central bank when his latest term expires at the end of this year after one more scheduled decision in November, having overseen Swedish monetary policy for 17 years.

Among a string of expected rate hikes later this week, US Federal Reserve is seen delivering a 75 basis-point increase, with the Bank of England also under pressure to step up the pace of monetary tightening.

As it seeks to catch up, the Riksbank is facing a dilemma familiar to its global peers, of how to dampen inflation without too much harm to the economy. That’s especially acute in Sweden, where household indebtedness is high and more than 40% of outstanding mortgages feature rates that are set for periods of no more than three months.

The increase in borrowing costs has so far led to an 8% decline in housing prices from a peak earlier this year, and a simultaneous run-up in energy and mortgage costs could lead to an accelerated slump.

The Riksbank cut all its growth forecasts, and now expects the Swedish economy to contract 0.7% next year instead of expanding by that amount. Officials raised their projection for the inflation measure that they target for 2022 and 2023, though they see an undershoot after that.

The decline in house prices will be slightly deeper than previously predicted, with an 18% drop from the peak now foreseen by policy makers.

“It would be even more painful for the Swedish economy if inflation were to remain at the current high levels,” officials said. “By raising the policy rate more now, the risk of high inflation in the longer term is reduced and thereby the need for an even greater monetary tightening further ahead.”

(Updates with Bloomberg Economics comment.)

©2022 Bloomberg L.P.