May 4, 2021

Saudi Private-Sector Employment Rises for First Time This Year

, Bloomberg News

(Bloomberg) --

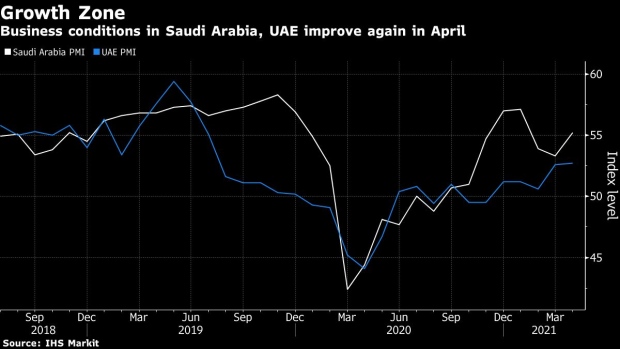

Business conditions in Saudi Arabia improved at the fastest pace in three months as firms increased their headcount for the first time this year.

“The Saudi Arabia PMI rebounded in April to indicate a strengthening of growth across the non-oil economy,” said David Owen, economist at IHS Markit. Non-oil private sector activity grew for an eighth consecutive month and the kingdom’s Purchasing Managers’ Index rose to 55.2 last month from 53.3 in March, remaining above the 50-mark separating growth from contraction.

“Despite a boost to demand, the business outlook weakened from March as fewer respondents projected that output would grow in the coming 12 months,” Owen said. “Current concerns among businesses included a possible further wave of Covid-19 that could exacerbate issues with foreign travel.”

PMI in neighboring United Arab Emirates rose fractionally to 52.7 from 52.6 in March, the highest since July 2019. Job losses continued for a third month, though business confidence gained momentum, with some firms reporting better conditions due to a fast rollout of vaccines for Covid-19.

More from IHS Markit:

- Saudi Arabia’s business outlook fell to a 10-month low, while job creation improved at the strongest pace since late 2019

- Output levels expanded due to a sharp increase in new orders, about a quarter of surveyed companies reported

- Demand growth picked up for the first time this year amid hopes of easing Covid-19 restrictions

- Export sales particularly from Asia strengthened

- New business growth aided a rise in input purchases, as the rate of expansion accelerated to a three-month high

- Global shortages in supply still led to an increase in freight charges during April, this was fueled further by rising oil prices

- In the UAE, a marked rise in new business volumes along with an expansion in output, connected to economic recovery from Covid-19 contributed to the monthly improvement

- Employment numbers fell for the third straight month as companies wanted to contain payroll costs instead of increase operating capacity

- Output charges were up for the first time in over two-and-a-half years, driven by rising input costs

- An index tracking new orders rose to a 20-month high, reflecting a significant increase in new business inflows

- The rollout of vaccines had contributed to improving market conditions and business expectations strengthened for a fifth month amid hopes of a Covid-19 recovery and an uptick in sales from Expo 2020

©2021 Bloomberg L.P.