Nov 1, 2022

Saudi Sends More Oil to China Despite Cutting Overall Shipments

, Bloomberg News

(Bloomberg) -- Saudi Arabia, the UAE and Iraq boosted their crude oil shipments to China last month, strengthening their share of a market that Russia has pushed into following the invasion of Ukraine.

The Middle East producers loaded almost 4 million barrels a day of crude for Chinese buyers in October. With some tankers yet to reveal their destinations, it’s possible the final figure will be revised up.

Russia has been racing to identify non-European markets for its crude this year after the 27-nation EU announced it would ban most seaborne purchases from the country in retaliation for its invasion of Ukraine. Since April, China’s total crude imports from Russia jumped about 20% year on year, customs data show.

So-far-published tanker trackers compiled by Bloomberg for October stand at nearly 38 million barrels a day, up by about 491,000 barrels a day from September.

Oil prices have rallied slightly after the Organization of Petroleum Exporting Countries and its allies pledged to cut oil production.

Russia, a key member of the OPEC+ alliance and under pressure from western sanctions, boosted shipments from its far east. It also started using the Northern Sea Route to get oil from the Arctic to China.

A table of flows is at the bottom of this story.

Highlights:

- Saudi Arabia’s exports decline but China takes most in months

- The UAE’s shipments to China highest since at least January 2017

- Russia also sending Arctic oil via Northern Sea Route

Brazil Flows At 5-Year High (7:37 p.m. London)

Exports of Brazilian crude in rose to the highest in data going back to 2017 amid strong flows to China, the top buyer of the country’s oil.

- Ships loaded 1.679m b/d in October, up 3% from a month ago and 42% higher from the previous year

- Flows to China rose 51% m/m to 777.4k b/d; highest volume to China since Feb. 2021

East Canada Exports Dive 37% (6:26 p.m.)

Crude exports from the Whiffen Head oil terminal in Newfoundland fell nearly 37% m/m to 155 b/d, or 4.8m bbl total.

- US-bound flows reached total 1.2m bbl vs 4m bbl in September

- Sailings to Europe inched up to 3.6m bbl

Azeri Flows Drop From 2-Year High (5:15 p.m.)

Flows of Azeri Light crude from the Baku-Tbilisi-Ceyhan pipeline fell last month from September’s two-year high.

- A total of 27 tankers loaded 19.9m bbl, or 641k b/d, of Azeri Light last month from Ceyhan

- Compares with 669k b/d for September that was the highest since April 2020

Iran’s Exports Recover (4:38 p.m.)

Iran’s observed crude and condensate exports rose in October, reversing about half of the previous month’s drop. Shipments from the Persian Gulf country mostly remain hidden.

Colombia Flows 15-Month Low (3:53 p.m.)

Exports of Colombian crude oil fell in October with the start of refinery maintenance season in the US

- Ships loaded 412.9k b/d from ports in Colombia and Ecuador in October, down 9.7% from the previous month

- Direct shipments to China +30% m/m as the state oil company Ecopetrol chartered a supertanker to Asia

US Gulf Coast Exports Edge Up (3:45 p.m. London)

Crude exports from the US Gulf Coast rose 1.3% m/m to reach 3.561m b/d in October, according to data compiled by Bloomberg

- Shipments to Europe rebounded ahead of the region’s planned ban on Russian supplies next month

- Purchases from top buyer Asia were broadly steady despite pullback from China

Caspian CPC flows from the Black Sea to Asia rise to 5-month high (3:14 p.m.)

Observed flows of Caspian CPC Blend crude from the Black Sea to Asia rose to the highest in five months in October, while shipments to the Mediterranean plunged, as bigger cargo size dampened buying interest from European refiners

- All cargoes for loading in October were in Suezmax size, or about 1m bbl, as producers tried to cope with loading restrictions at the terminal

- About 1.74m tons of CPC Blend were shipped to Asia in October, the highest since May, compared with 1.06m tons in September

UAE Shipments to China Hit a Mult-Year High (2:36 p.m.)

Crude and condensate shipments from the UAE recovered part of the previous month’s loss in October, with flows to China rising to their highest since at least January 2017

- Total observed exports rose by 1% m/m to 3.51m b/d, or a total of 108.7m bbl, in October. Compares with 3.485m b/d in September

- Flows on tankers showing destinations in China edged up m/m to their highest level since Bloomberg began tracking shipments in detail in January 2017

South Sudan Flows Rebound (1:35 p.m. London)

Seven tankers loaded an estimated 4.2m bbl, or 135k b/d, from the Bashayer terminal in neighboring Sudan, up from 120k b/d in September

- Exports of South Sudan’s Dar Blend and Nile Blend crudes rebounded in October, recouping most of the volume lost the previous month.

Algeria Shipments Reach 1-Year High (1 p.m.)

Observed crude and condensate exports from Algeria jumped to their highest level since October 2021, according to port lineup and tanker-tracking data compiled by Bloomberg. The increases were in flows to Europe and North America, where buyers have been seeking alternatives to shunned Russian barrels.

- Total observed shipments rose by about 67% to 560k b/d in October from 336k b/d in September

Iraq Flows Highest Since April 2020 (12:56 p.m.)

Iraq’s crude exports rose to the highest since April 2020, when producers were engaged in a production free-for-all after the collapse of the first OPEC+ agreement and before they implemented output cuts in response to the Covid-19 pandemic.

- Total crude exports increased to 3.84m b/d last month from a revised 3.63m b/d in September, according to tanker-tracking and port-agent data compiled by Bloomberg

- Sales to China rose to 1.14m b/d compared with 1.01m b/d in September

North Sea Flows to Asia Stable; Europe Takes Most (12:40 p.m.)

Observed flows of North Sea crude to Asia last month were near an 8-month high, having recovered from a slump over the summer. Flows to the region are still down y/y as Europe takes more supply.

- Asia will receive about 6m bbl, or 194k b/d, of North Sea crude that loaded in October

- That’s little changed from 6m bbl, or 200k b/d, in September when volumes rose to the highest since February, according to port agent report and ship-tracking data compiled by Bloomberg

- Europe received at least 39.8m bbl, or 1.28m b/d, of North Sea crude for October loading

- That represents about 84% of October cargoes that have shown final destinations, little changed from 85% for September, and compares with 94%-99% for June-August

- NOTE: European refiners significantly increased their imports of North Sea crude after Russia’s invasion of Ukraine

- In total, a combined 60.7m bbl, or 1.96m b/d, of 20 main North Sea crude grades were shipped in October

Saudi Flows Fall, China Gets More (11:29 a.m. London)

Observed crude exports from Saudi Arabia slipped in October, while the Middle Eastern supplier maintained its market presence in Asia despite Russia’s increased focus on the region in the wake of sanctions.

- Exports were about 7.3m b/d in October, from 7.5m in September

- Saudi officials didn’t immediately respond to a request for comment

- Flows to China, the primary destination, edged higher at 1.8m b/d; reached highest since April and may be revised as more cargo destinations become known

- In early October, OPEC+ agreed to trim output by 2m b/d from November, the biggest cut since 2020

Oman Shipments Highest Since March (11:05 a.m.)

Omani exports of crude and condensates jumped in October to their highest level in seven months, driven by an increase in flows to Japan and South Korea.

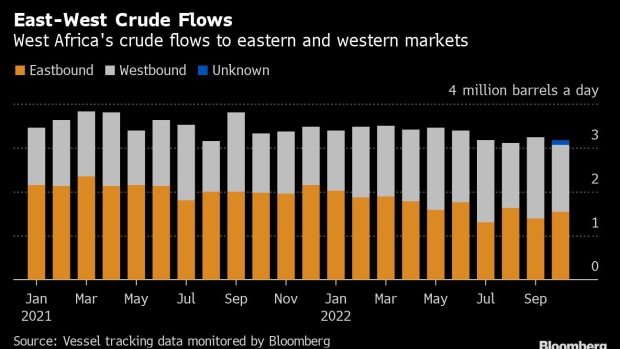

West Africa Flows Dip Despite Forcados (10:49 a.m. London)

Oil exports from West Africa edged lower in October, despite the restart of shipments from Nigeria’s Forcados terminal, one of the country’s largest.

- Observed crude and condensate shipments from 10 countries tracked by Bloomberg fell by 64k b/d in October to 3.19m b/d, from 3.26m in September

- Nigeria’s crude and condensate exports averaged 1.24m b/d, up by 32k b/d m/m

- Observed shipments to China rose by 224k b/d to 886k b/d in October, a figure that may well get revised higher when the destinations of more tankers become known

- 831k b/d headed to identified European ports in October, with another 124k b/d heading west from WAF terminals without signaling a clear destination

Qatar Cargoes to India Hit 6-Month High (10:49 a.m.)

Qatar’s oil exports to India in October jumped to their highest since Middle Eastern producers began to face competition there from an influx of cut-price Russian barrels back in April.

- Total monthly observed crude and condensate exports were virtually unchanged last month at 901k b/d, or 27.9m bbl

- That compares with 902k b/d in September

- Exports to India jumped m/m in October to a six-month high of 118k b/d

- Shipments to China slumped to 150k b/d, down from 266k b/d in September, which was the highest since August 2020

Asia Demand Pulls Kuwait Flows to 8-Month High (10:47 a.m.)

Kuwait’s observed crude exports climbed above the 2m b/d marker in October to the highest since February, led by increased flows to South Korea and Vietnam.

- Total shipments from Kuwait rose by 70k b/d, or 3.6%, to about 2.04m b/d last month from 1.97m b/d in September, tanker-tracking data compiled by Bloomberg show

- Cargoes headed for biggest-buyer China remained elevated, at at least 613k b/d

- September’s revised 800k b/d was the highest in tracking data going back to October 2016

- Exports to Myanmar almost doubled m/m, while flows to Taiwan were little changed

Arctic Flows Up, Northern Sea Route Used (9:57 a.m.)

Crude shipments from the Arctic port of Murmansk rose in October, with the first cargo of crude sailing from Murmansk to China via the Northern Sea Route along the north coast of Russia. It will be the first delivery from the port to the Asian nation since January 2021.

- Murmansk shipments averaged 313k b/d in October, up from 240k b/d in September, according to vessel-tracking data monitored by Bloomberg

- A first cargo of crude is on its way from Murmansk to China via the Northern Sea Route along the Arctic coast of Russia

- Shipments to Asian buyers increased to a record 100k b/d vs 67k b/d in September, with exports to India up to 84k b/d

- Flows to Rotterdam rose to 97k b/d from 53k b/d, but remained below those to Italy for a second month

- Last month, Murmansk took delivery of 361k b/d of crude from terminals along Russia’s northern coast, tracking data monitored by Bloomberg show

Sokol Restart Lifts Russia Pacific Cargoes (9:21 a.m.)

Observed shipments of Russian crude from its Pacific coast terminals rose to a six-month high after flows of Sokol resumed from the De Kastri terminal following Exxon’s ouster from the Sakhalin 1 project.

- Total exports from terminals at Kozmino and De Kastri on the Russian mainland, and Prigorodnoye on Sakhalin Island, increased to 964k b/d in October from 803k b/d in September, according to tanker-tracking data monitored by Bloomberg

- A record 36 tankers departed from Kozmino in October, up from 30 the previous month

- Two Sokol crude cargoes were shipped in October after the grade was absent from the market for four months

- Flows to China increased to 825k b/d from 754k b/d in September; that’s the highest since May

Libya Flows Top 1.1m B/D for 2nd Month (8:05 a.m.)

Libya’s observed crude and condensate shipments slipped slightly in October, but exceeded 1.1m b/d for a second straight month after recovering from a slump that began in March.

- The country loaded 1.15m b/d in October, down from a revised 1.19m b/d in September

- Italy was the biggest destination, taking one-third of the volume shipped, followed by Spain and the Netherlands, which each accounted for about 10% Libya’s exports

Venezuela Lifts Exports From Inventory (5:43 p.m. Monday)

State-oil company PDVSA drew from inventories to boost oil exports in October,.

- Exports measured by vessel loadings rose to 509k b/d in October, up 6.8% from September and down 2.4% from a year earlier

- Inventories at the port of Jose and the upgraders dropped to 6.4m bbl as of Oct. 30 from 8.1m bbl on Sept. 30

Russia-Origin Urals to Europe Stay Low (4:59 p.m.)

Observed flows of Urals crude to Europe from Russia’s three main western ports remained low in October, as the continent’s refiners continued to cut imports before sanctions come into force in December.

- A total of 1.9m tons, or 449k b/d, of Russia-origin Urals for October loading were headed to Europe, according to ship-tracking data compiled by Bloomberg

- That compares with 1.78m tons or 435k b/d in September

- Excluding cargoes of Lukoil, the volume fell further to only 400k tons, or 95k b/d in October, compared with 235k b/d for September

- NOTE: Lukoil runs refineries in Italy, Romania and Bulgaria

- Asia currently scheduled to receive at least 3.32m tons of October-loading Urals, below the 3.9m tons seen in September; the volume is expected to be revised higher as tankers with a combined 840k tons have yet to show final destinations, and most will go to Asia

- Turkey will receive 1.28m tons of Urals for October loading, compared with 1.52m tons in September

- In total, 8.4m tons, or 1.99m b/d, of Urals were loaded from the three ports in October, compared with 8.12m tons, or 1.98m b/d, in September

Mexico Exports Drop With Less to Asia (3:29 p.m.)

Mexican oil exports fell in October as a drop in shipments to South Korea and India outweighed an increase in flows to the US.

- Exports measured by ship loadings were 994.8k b/d in October, down 5.5% from the previous month and 5.6% higher from a year ago

- To India -33% m/m as Indian Oil skipped cargoes; to South Korea -17% on less demand from Hyundai Oilbank

- Shipments to US +5.8% m/m after PMI slashed the official selling price of Maya crude oil to compete with increased competition from Canadian barrels

The following table is in ‘000s of barrels a day:

©2022 Bloomberg L.P.