May 12, 2022

Schroders, BlackRock, Pimco Face Losses as Adler’s Troubles Grow

, Bloomberg News

(Bloomberg) -- A Wall Street bank and some of the world’s largest money managers stand to lose hundreds of millions of euros in the crisis that’s rocked the world of German real estate.

Around 7.5 billion euros ($7.9 billion) of debt held in part by Schroders Plc, Pacific Investment Management Co LLC, Morgan Stanley, and BlackRock Inc. hangs in the balance after a series of dramatic developments ripped through the German landlord Adler Group SA and its web of interconnected real estate firms.

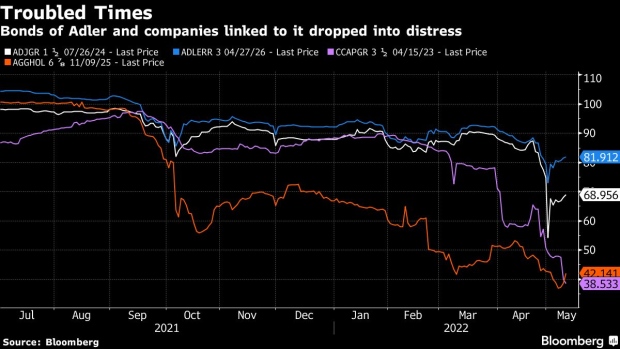

In recent years Adler has grown from a little-known property firm to become one of Germany’s biggest landlords, funded by a who’s who of global finance, eager to capitalize on the higher yields the property firm offered. But its bonds started to slide last summer and now the company faces a funding crunch, just as the era of easy money draws to a close, leaving those who had wagered on the company’s 4.5 billion euros of notes nursing heavy losses.

“Adler was always a leveraged play on the German residential sector, which is cyclical in its nature,” said Ash Nadershahi, a portfolio manager at Three Bridge Capital, a New York-based investment management firm. “There are time bombs in all these portfolios.”

Schroders holds about $386 million equivalent of Adler bonds, according to data compiled by Bloomberg, making the U.K. money manager the largest holder of the company’s debt. The investment firm purchased the bonds when they were trading at or around face value and its position was last reported in December 2021. Its holdings are still sizeable, according to people familiar.

Some of those bonds have tumbled to as low as 54 cents on the euro in recent weeks, losing more than 40% of their face value within the last year. BlackRock amassed about $130 million of the bonds, while Pimco holds just under $90 million, the data shows, as of May 2022.

And it’s not just money managers that have stocked up on the company’s ailing debt. One of its past lenders, Morgan Stanley, holds Adler’s bonds and also has underwritten some of the $365 million of credit default swaps that will pay out if the Adler Real Estate subsidiary defaults, according to the people familiar with the matter.

It’s not clear how much of Morgan Stanley’s holding is on the bank’s own behalf and how much is held for clients. The bank held meetings with investors in recent months to pitch them on buying the debt, according to some of the people.

The crisis engulfing the firm has also pummeled the bonds of its former main shareholder, Aggregate Holdings SA, as well as associated real estate firms, Corestate Capital Holding SA and Accentro Real Estate AG, some of whose notes are also owned by the same institutional investors.

Representatives for Adler Group, BlackRock, Morgan Stanley, Pimco and Schroders declined to comment.

Falling Faster

Adler’s bonds and stock plummeted to record lows in recent weeks after the firm’s auditor, KPMG, refused to endorse its accounts and failed to refute several key accusations against the company in a report by prominent short-seller Fraser Perring. Adler had commissioned the review in response to Perring’s accusation that the company was engaging in systemic fraud for the benefit of a small group of investors.

The cost of the insurance contracts on the bonds, or credit-default swaps, soared as the company’s prospects soured, and they’re now pricing in a record 77% chance that Adler defaults within the next five years. The shares plunged anew on Friday after bondholders began seeking legal advice about potential breaches of the agreements governing the bonds.

Adler Group chairman Stefan Kirsten said the company is still working to clear up issues with its auditor and that it’s not in breach of bond terms.

Domino Effect

At the heart of the report published last year by Perring’s Viceroy Research was Austrian entrepreneur Cevdet Caner. Caner’s family owns a stake in Adler, and a whistleblower’s account of his activities sent to banks said he improperly influenced the firm as the silent mastermind behind some of its controversial deals. Adler consistently denied Viceroy’s allegations, while Caner filed a criminal complaint against Perring.

Institutional asset managers are now looking for the exits. Hedge funds have begun to step in and scoop up Adler debt at discounted prices. As the more seasoned players in debt restructurings, hedge funds are likely to try and identify a breach to push the firm into default and accelerate claims on bonds and assets.

For Pimco, its potential losses extend to Corestate. The money manager holds about 120 million euros of the firm’s unsecured and convertible bonds, according to data compiled by Bloomberg. Those notes have fallen to about 40 cents in recent weeks after the firm slashed its earnings and cut asset valuations following delayed audit of its accounts.

Consus Real Estate, the troubled property development unit of Adler Group that’s seen a near total writedown, accounted for a quarter of one of Corestate’s funds as of the end of 2018, the last time the firm reported its holdings.

Last week, a group of bondholders to Corestate Capital Holding SA hired Houlihan Lokey Inc. as a restructuring adviser amid expectations the German real estate financing firm will struggle to repay its upcoming debt maturities. The company also said on Tuesday it appointed advisers to review its debt.

Meanwhile, Aggregate, one of Adler’s largest shareholders, disposed of its stake in Corestate late last year as it rushed to sell assets to shore up finances in the wake of Adler’s crisis. Aggregate has just over 2 billion euros of bonds outstanding between its parent and operational companies.

Mudrick Capital Management LP holds the largest position of the 250 million euro convertible bond for VIC Properties, a Portuguese unit tied to Aggregate.

“Investors didn’t really know the risk, but QE and the rush to buy yield pulled them in and it’s proving to be fatal,” Nadershahi from Three Bridge Capital said. “And this is just the beginning.”

©2022 Bloomberg L.P.