Feb 9, 2023

Serbia Lifts Rates Again as Inflation Stays Far Above Goal

, Bloomberg News

(Bloomberg) -- Serbia raised the benchmark interest rate to extend its steep monetary tightening as policy makers seek to tame the worst inflation in at least 15 years.

The National Bank of Serbia increased its one-week rate by a quarter percentage point to 5.5%, in line with expectations of almost all economists in a Bloomberg survey. The 11th consecutive hike brought the key rate to the highest level since 2015.

“Despite signs of easing, global price pressures are still high, and it’s necessary to limit their indirect effects on growth of prices on the domestic market, which can develop through inflationary expectations,” the central bank said when announcing the decision. Policy makers also shifted the deposit and credit rates to 4.5% and 6.5% respectively.

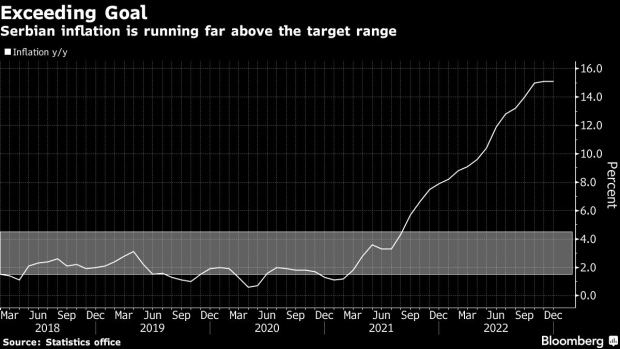

Serbia’s consumer prices jumped 15.1% from a year earlier in December, the same pace as in the previous month. Inflation pressures may be peaking, but price growth still remains far above the target range of 1.5%-4.5%.

A latecomer to the rate hike frenzy in the region, Serbia had resisted for months to lift borrowing costs, seeking first to defuse price pressures with alternative tools. Policy makers initially focused more on core inflation, which also accelerated and came in at 10.1% in December.

“We expect the central bank to end its hiking cycle and remain on hold on the next few meetings at least,” Mate Jelic, a senior macroeconomic analyst at Erste Group, said in a note.

The Balkan nation has raised borrowing costs by a cumulative 450 basis-points from a record low last April.

A Bloomberg survey sees Serbia’s tightening continuing, with the main rate possibly peaking at 5.75% in April, even as economic growth has slowed for six consecutive quarters.

--With assistance from Harumi Ichikura.

(Updates with central bank comment in third paragraph.)

©2023 Bloomberg L.P.