Apr 3, 2023

Shock OPEC+ Output Cuts to Hit Demand and Rates for Oil Tankers

, Bloomberg News

(Bloomberg) -- OPEC+’s shock decision to cut oil production isn’t just redrawing the outlook for crude prices, it’s also hit the prospects of tanker companies that transport the barrels.

Shares of oil tanker pureplays including Frontline Plc, Euronav NV and DHT Holdings Inc. all slumped on Monday after the alliance of producers surprised the market with a surprise output cut of about 1 million barrels a day.

About 40% of global crude output is transported by sea, meaning a substantial loss of cargoes seems likely. Clarksons Securities AS, a unit of the world’s biggest shipbroker, said the largest supertankers could see their earnings temporarily slump by about a third from the resulting decline in cargoes.

“This is an obvious negative,” said Halvor Ellefsen, a tanker broker at Fearnleys Shipbrokers UK Ltd. who’s worked in the industry for almost four decades. “It’s not what owners needed.”

The production cuts will probably lead to a real loss in supply and tighten global oil markets because those doing the cutting are largely pumping at their quotas, Oil Brokerage Ltd. said in an emailed note Monday.

Russia’s invasion of Ukraine and ensuing western sanctions had tilted the market in owners’ favor.

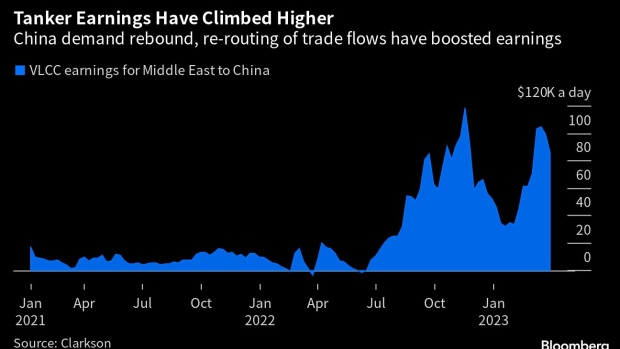

Vessels that previously delivered oil a few thousand miles to Europe are now having to transport it all the way to Asia, keeping tankers employed for longer and boosting vessel earnings.

China’s exit from Covid-zero policies has also fired up the economy of the nation that has long been the driver of oil demand growth, with buyers shipping millions of barrels of extra crude.

Rates for modern ships with equipment to run cheap fuel are earning not far of $100,000 a day, a very high level by historical standards, according to data from Clarkson Research Services Ltd.

The US may also curtail some exports in the coming months because its own refineries will likely boost processing as they come out of seasonal maintenance, further diminishing the flow of cargoes, Fearnleys’ Ellefsen said.

While US crude exports are likely to slow after hitting a record high earlier this year, the market awaits Biden administration’s response on OPEC+’s move, said Greg Lewis, analyst at BTIG LLC.

See also: Biden Has Limited Options to Respond to OPEC+’s Oil Cut

Still, the output curbs will be offset if Asian refiners have to source barrels from far flung suppliers in the Atlantic Basin instead of the Middle East, where the cuts are focused, said Brian Gallagher, head of investor relations at Euronav. It will serve to “trim” fleet utilization in what are “very strong markets,” he said.

Clarksons’ analyst Frode Morkedal also said that the OPEC+ step is precautionary and as such may not have a lasting impact on demand for tankers if consumption picks up. The number of new vessels being built is also low, which should support rates, he said.

--With assistance from Alex Longley and Alaric Nightingale.

(Updates with more analyst reaction in fifth, 11th and 12th paragraphs.)

©2023 Bloomberg L.P.