Feb 17, 2022

Shopify stock-price target gutted by analysts on slower growth

, Bloomberg News

Shopify shares continue to slide lower

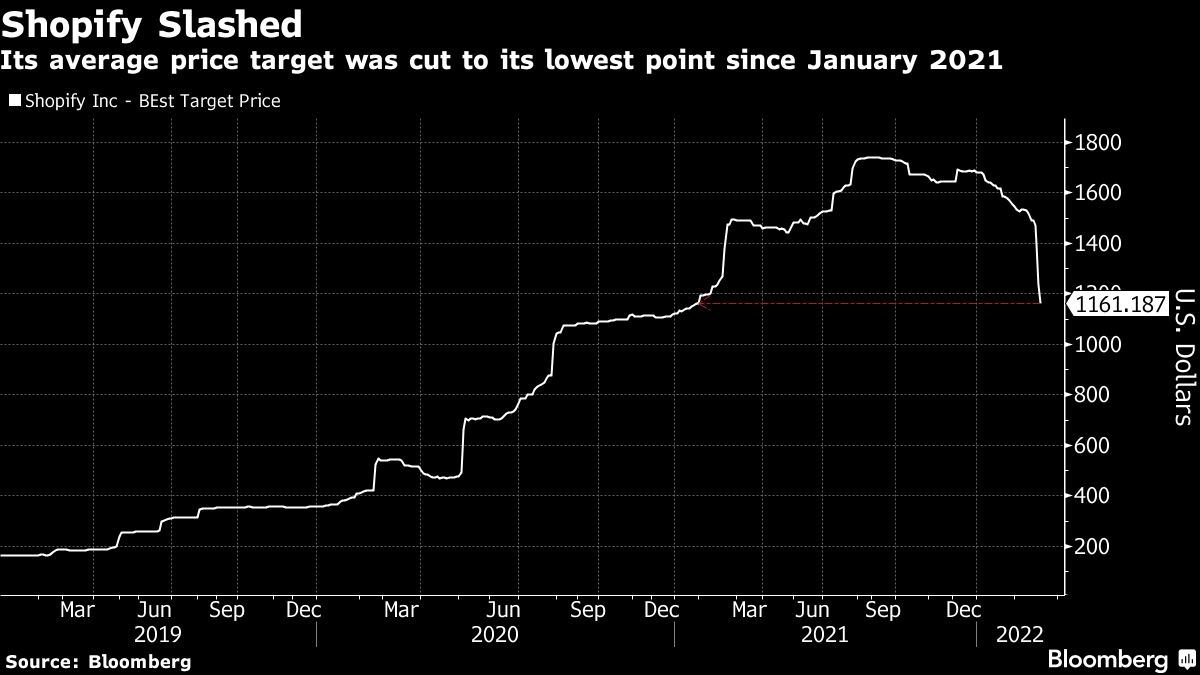

Canadian e-commerce company Shopify Inc. had the average price target on its shares slashed to the lowest level since January 2021 after it signaled slower sales growth.

More than 20 analysts cut their targets after the stock plunged 17 per cent in Toronto on Wednesday, its biggest drop ever, following a company statement that full-year revenue growth will be lower than the 57 per cent increase in 2021. Shares extended losses Thursday, tumbling 11 per cent to the lowest since April 2020.

Shopify’s business surged during the pandemic, with sales jumping 86 per cent in 2020 as shoppers moved online. It became Canada’s most valuable company by market capitalization, overtaking Royal Bank of Canada. It surrendered that position in December amid a broader tech selloff, and as shoppers returned to brick-and-mortar stores.

Last month, Shopify said it had canceled warehouse and fulfillment-center contracts, pushing shares to a 16-month low. The company has tumbled almost 50 per cent this year, losing about $100 billion (US$79 billion) in market value.

“The reality is that the above ‘in-line’ results combined with no firm outlook guidance was not enough,” National Bank analyst Richard Tse said in a note to clients. “If the above wasn’t enough to cause pause, a further notable fly in the ointment was a shift in the company’s SFN (fulfillment) strategy to own or run more of the major fulfillment hubs.”

Even as targets were gutted, analysts are largely positive on the stock: Shopify has only one sell rating, with 27 buys and 19 holds.