Mar 26, 2024

Singapore Warehouses Are Filling Up With Surplus Lead and Zinc

, Bloomberg News

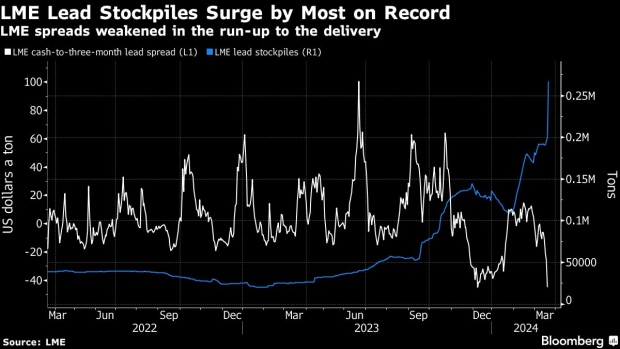

(Bloomberg) -- A record delivery of lead into London Metal Exchange warehouses in Singapore has underscored the city state’s emergence as a dumping ground for surplus industrial metals as a global downturn in demand drags on.

More than 64,000 tons of lead flooded into the port last Wednesday, a 34% rise that lifted total inventories to the highest since 2013. A large percentage of that particular material was delivered by Citigroup Inc., according to people familiar with the matter, after spot prices rose relative to futures, making it costlier to keep hold of the material.

The surge in stockpiles offers fresh evidence that a long spell of undersupply is ending in some metals as industrial activity weakens and high interest rates sap demand for manufactured goods like automobiles — which account for about 85% of lead demand.

But it also reflects shifting dynamics on the LME as traders and warehouses respond to weaker markets. The past year has seen a return of metal financing plays as a major driver — with Citi emerging as key participant — and so-called “rent sharing” deals being offered by warehouses are incentivising deliveries in places like Singapore that haven’t typically drawn huge volumes.

Read: Citi’s Mega Metals Trade Shows Global Markets Turning to Glut

A spokesperson for Citi declined to comment.

The lead market has long been a backwater compared to larger industrial metals like copper, but investor interest has grown since its inclusion in the Bloomberg Commodity Index in 2023. Its usage in conventional car batteries has also made it a proxy bet on the speed of the global switch to electric vehicles, with large increases in both bearish and bullish positioning seen in recent months as prices have traded sideways.

The big influx of material has meant that LME storage availability is now getting tight in Singapore, some of the people said.

Singapore has traditionally been an unpopular storage point for buyers looking to obtain metal, due to high logistic costs and land rental prices. Now that the metal is there, those additional costs — and the downbeat outlook for demand — mean that it’s unlikely to leave the port soon, some of the people said.

Singapore’s emergence as the LME’s key storage hub for lead and zinc partly reflects the effect of incentives for metal deliveries that are being offered by certain warehousing companies.

Rent sharing deals — made popular during a massive years-long glut in the aluminum market — give traders who deliver surplus cargoes into storage a share of the rent that warehouses collect from future owners. The total volume of LME metals stored in the port has now reached the highest level since 2014, when it was home to massive amounts of aluminum.

People familiar with the deals say they’ve sparked a tug-of-war over stocks in Singapore and other ports, with owners withdrawing metal that’s subject to rent-share deals and moving it into cheaper warehouses — sometimes just few a minutes down the road. Besides creating logistical logjams, a constant shuffling of stocks between warehouses risks sending a distorting signal about the strength of supply and demand.

Even so, analysts reiterated that the latest surge in inventories reflects how comfortably supplied the lead and zinc markets have become.

Spreads between nearby LME contracts and later-dated futures have also pointed to an emerging glut, with spot prices trading at a record discount after the delivery. Zinc spreads also hit a record intraday discount on Tuesday, following on from a steady rebound in inventories in Singapore.

Depots in Singapore were virtually empty a year ago, but now hold more than $900 million worth of lead and zinc — accounting for more than 70% of the LME’s global lead inventory, and 83% of LME zinc stocks.

“Ultimately, it shows that that there’s a reasonable chunk of metal that’s not needed,” said Dan Smith, head of metals research at Amalgamated Metal Trading Ltd. “Traders’ natural inclination is to keep hold of stock because they want to have metal to sell to people when things get tight, so it’s normally a pretty negative sign when they’re looking to offload stock.”

Lead prices traded down 0.7% lower on the LME on Tuesday, while zinc dropped 2.1%.

--With assistance from Jack Farchy and Archie Hunter.

©2024 Bloomberg L.P.